Vital Statistics:

|

Last |

Change |

| S&P Futures |

2850.3 |

9.0 |

| Eurostoxx Index |

401.9 |

1.1 |

| Oil (WTI) |

66.5 |

0.8 |

| US dollar index |

82.9 |

-0.4 |

| 10 Year Govt Bond Yield |

2.65% |

|

| Current Coupon Fannie Mae TBA |

103.591 |

|

| Current Coupon Ginnie Mae TBA |

103.688 |

|

| 30 Year Fixed Rate Mortgage |

4.17 |

|

Stocks are higher after the European Central Bank left rates unchanged. Bonds and MBS are flat as well.

The German Bund is getting pounded on the ECB decision. At some point the weakness will probably flow through to Treasuries.

Treasury Secretary Steve Mnuchin noted that a weaker dollar is beneficial for trade and opportunities. He was peppered with questions over whether that amounts to a change from the government's historical support for a stronger dollar. He later clarified his remarks, however the currency is getting hit a little on the remarks and persistent dollar weakness will eventually translate into higher rates.

Mortgage Applications increased 4.5% last week as purchases rose 6% and refis rose 1%. These numbers are adjusted for the MLK holiday. Note that the Spring Selling Season is just around the corner - it unofficially starts right around Super Bowl Sunday.

New Home Sales fell to 625k in December a drop from November's downward-revised 679k print. November's number was an outlier and was sure to be revised down, which probably explains why the estimates were too high.

The Index of Leading Economic Indicators improved to 0.6% from 0.5%.

Initial Jobless Claims rose to 233k from a downward-revised 216k the week before. The last time the US hit 216k initial filings, we had a military draft.

House prices rose 0.4% month-over-month and 6.5% YOY

according to the FHFA House Price Index. As usual, the West Coast and Mountain States led while the Northeast / Mid-Atlantic lagged.

Existing Home Sales fell 3.6% MOM in December and are up 1.1% YOY, according to NAR. Inventory for sale fell 10.3% to under 1.5 million units which is a record low. (going back to 1999) 1.5 million units represents only 3.2 months' worth at the current sales pace. A balanced market is about 6.5 months. The median home price rose 5.8% to $246,800. The first-time homebuyer was 32% of sales, flat YOY.

Median income in the US probably came in around 60k for the end of 2017. This would put the median house price to median income ratio at 4.1 times. Historically, that number has been in the 3.1 - 3.6 range, however differences in interest rates probably explain some of that. Given the tightness in inventory and what appears to be the stirrings of wage growth, house prices should be in for another strong year. The wild card will be the luxury properties in high tax states which are becoming less affordable due to tax reform.

Note that luxury home prices did rise 7% in Q4, according to Redfin.

The Home Despot is not living up to its name.

$1,000 bonuses for employees.

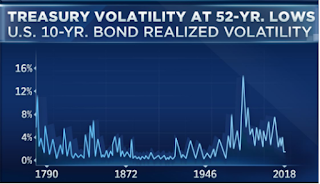

Many loan officers have noticed that FHA and VA pricing has been terrible as of late, especially when compared to conventional rates. This is an industry-wide phenomenon. Nobody really has a good explanation of why this is happening, although it is being driven by a lack of investor appetite for higher coupon Ginnie Mae TBAs. As a general rule, Ginnie Mae TBAs are more sensitive to rate changes than Fannie Mae TBAs, so any increase in volatility will affect Ginnies disproportionately. This is especially strange since the government has taken steps to protect MBS investors from serial refinancings. Whatever the cause, the pricing is being driven by the machinations of the primary TBA market and not internal pricing changes.

Mick Mulvaney, Acting Director at the CFPB,

put out a memo to staff recently giving his philosophy going forward. Suffice it to say, he will not be another Richard Cordray. It is worth reading in its entirety, as it largely amounts to a rebuke of his predecessor. Richard Cordray was quoted in Politico saying : “We wanted to send a message: There’s a new cop on the beat… Pushing the envelope is a

loaded phrase, but that’s absolutely what we did.” Mulvaney's response: "Simply put: that is what is going to be different. In fact, that entire governing philosophy of pushing the

envelope frightens me a little. I would hope it would bother you as well.

We are government employees.

We don’t just work for the government, we work for the people. And

that means everyone: those who use credit cards, and those who provide those cards; those who take

loans, and those who make them; those who buy cars, and those who sell them. All of those people

are part of what makes this country great. And all of them deserve to be treated fairly by their

government. There is a reason that Lady Justice wears a blindfold and carries a balance, along with her

sword."

Other key points:

"When it comes to enforcement, we will be focusing on quantifiable and unavoidable harm to the

consumer. If we find that it exists, you can count on us to vigorously pursue the appropriate

remedies. If it doesn’t, we won’t go looking for excuses to bring lawsuits."

"On regulation, it seems that the people we regulate should have the right to know what the rules are

before being charged with breaking them. This means more formal rulemaking on which financial

institutions can rely, and

less regulation by enforcement."

"Speaking of data: the Dodd Frank Act requires us to “

consider the potential costs and benefits to

consumers and covered persons.” To me, that means quantitative analysis. And while qualitative

analysis certainly can play a role, it should not be to the exclusion of measurable “costs and benefits.” In

other words: there is a lot more math in our future."