| Last | Change | Percent | |

| S&P Futures | 1548.6 | -1.9 | -0.12% |

| Eurostoxx Index | 2715.7 | -3.0 | -0.11% |

| Oil (WTI) | 92.49 | 0.4 | 0.47% |

| LIBOR | 0.281 | 0.001 | 0.36% |

| US Dollar Index (DXY) | 82.6 | 0.030 | 0.04% |

| 10 Year Govt Bond Yield | 2.04% | -0.02% | |

| RPX Composite Real Estate Index | 194.1 | -0.1 |

Markets are taking a breather after a string of gains over the past week and a half. The Dow Jones Industrial Average is at a record high, and the S&P 500 is within striking distance of its 2007 high. Bonds are catching a bounce after a lousy week. MBS are up as well.

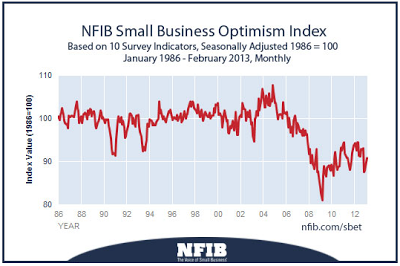

The National Federation of Independent Businesses reported that small business optimism increased small in February to 90.8, and is returning to its post crisis norm. It is still well below its historical average, and even below the lows of the 91-92 recession and the 01-02 recession. The report makes an interesting study in contrasts - while the stock market indices are approaching record highs, and earnings are at or near record highs, the small business sector is still stuck in the morass that began in 2008. The reason for that international sales account for a bigger percent of the S&P 500, and that has been doing better than the US (Europe notwithstanding). On the other hand, restaurants and retailers, the backbone of small business in the US, are still having a tough go of it as consumers continue to de-leverage. Construction, energy, and manufacturing were the bright spots of the report.

Given Friday's positive jobs report, how long will it take us to get to full employment? Of course it depends on the labor force participation rate. The low labor force participation rate is what has been holding down the unemployment numbers, as people who have been unemployed over 6 months but are not actively looking for a job are no longer counted among the unemployed. If those people started looking for jobs again, they would start counting as unemployed and the unemployment percentage would increase. If the labor force participation rate remains stuck at the current lows, it would take 49 months. If it went back to historical norms, it would take 73 months.

Mary Jo White promises to get tough on Wall Street if she is confirmed as head of the SEC. Finishing rulemaking under Dodd-Frank is an "immediate imperative" as well. High Frequency Trading will also be a focus. She is expected to be confirmed.

No comments:

Post a Comment