| Last | Change | Percent | |

| S&P Futures | 2055.3 | 0.1 | 0.00% |

| Eurostoxx Index | 3013.3 | -30.8 | -1.01% |

| Oil (WTI) | 38.38 | 0.1 | 0.16% |

| LIBOR | 0.631 | 0.002 | 0.36% |

| US Dollar Index (DXY) | 94.45 | -0.389 | -0.41% |

| 10 Year Govt Bond Yield | 1.82% | 0.00% | |

| Current Coupon Ginnie Mae TBA | 105.4 | ||

| Current Coupon Fannie Mae TBA | 104.7 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.81 |

Markets are flattish on no real news. Bonds and MBS are flat as well.

Initial Jobless Claims rose to 276k from 265k last week.

In other economic data, the ISM Milwaukee rose to 57.8 while the Chicago purchasing Manager Index jumped. Consumer comfort fell however to 42.8.

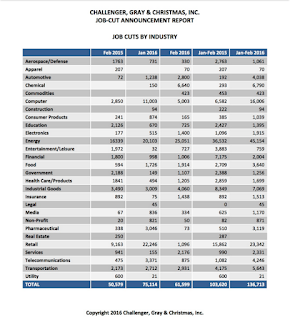

Job cuts fell 13,4k to 48.2k in March, according to outplacement firm Challenger Gray, and Christmas.

Note that Boeing announced 4500 job cuts yesterday, and the financial industry is going through another round of lay-offs.

Not everything is grim in the labor markets, however. Some parts of the country are seeing outsized wage growth.

Mohammed El-Arian on what to look for in tomorrow's jobs report. The numbers to watch: wage growth and the labor force participation rate.

TRID issues have shut the jumbo securitization market down for the moment. Non-bank jumbo originators are sitting on the sidelines at the moment because they can't move their inventory. Another unintended consequence of TRID.

One unappreciated fact relating to the 10 year has been the massive short position that built up in them ahead of the Fed's hiking rates. Now that the Fed is becoming more dovish, it is creating a short squeeze in Treasuries, which is pushing down rates. The punch line is that the bid under Treasuries (and thus the forces pushing yields down) are somewhat temporary.