| Last | Change | Percent | |

| S&P Futures | 1980.6 | -3.0 | -0.15% |

| Eurostoxx Index | 3008.4 | -13.7 | -0.45% |

| Oil (WTI) | 34.41 | -0.3 | -0.72% |

| LIBOR | 0.632 | -0.002 | -0.24% |

| US Dollar Index (DXY) | 97.98 | -0.232 | -0.24% |

| 10 Year Govt Bond Yield | 1.85% | 0.01% | |

| Current Coupon Ginnie Mae TBA | 105.4 | ||

| Current Coupon Fannie Mae TBA | 104.5 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.68 |

Stocks are slightly lower as a slew of economic data comes in this morning. Bonds and MBS are flattish.

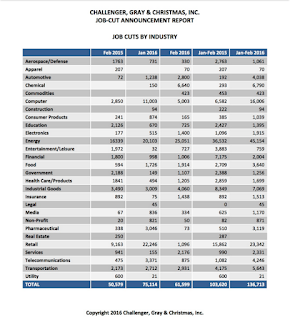

Outplacement firm Challenger, Gray and Christmas reported that announced job cuts rose 21.8% in February to 61.6k. The energy sector accounted for 25k of the losses, followed by chemicals, computer, and industrial goods. The West and the Midwest bore the brunt of the cuts. Remember these are announced job cuts and often never actually happen. Overall, the employment picture is looking decent, however we'll get a better look tomorrow.

Here is a table of the industries hit. Note that aside from energy, job cuts are pretty low. Note that these are not net numbers either - they don't take into account any sort of hiring.

Initial Jobless Claims rose to 278k last week. Anything below 300k is a good number.

The ISM Non-manufacturing composite fell slightly to 53.4 in February from 53.5 in January. Business continues to be decent in the services sector.

Factory Orders fell 1.6% in January, while durable goods orders rose 4.7%. Capital Goods Orders rose 3.4%.

Why is wage growth so difficult to find? Productivity growth has been weak since peaking around 1999 - 2000. This was the tail end of the big boost from the Internet and the decade-long transformation of the PC into a tool on everyone's desk. Last quarter it came in at -2.2%. Productivity has been negative for 3 out of the past 4 years, and that is not a recipe for wage inflation.

Unit Labor costs rose 3.3% in the fourth quarter, which drove the drop in productivity as output only increased 1%.

The Markit US Services PMI fell slightly in February to 49.7 while the composite PMI was flat at 50.

The Bloomberg Consumer Comfort Index fell to 43.6 from 44.2 last week. Falling perceptions of the economy drove the decline.

2012 Presidential Nominee Mitt Romney is going to try and push back the Trumpmentum with a speech tonight.

Nothing too earth-shattering in the Fed's Beige Book which was released yesterday. Overall, manufacturing is flattish compared to last month, however labor markets improved overall, and "wage growth varied considerably, from flat to strong, across all districts."

No comments:

Post a Comment