| Last | Change | Percent | |

| S&P Futures | 1989.1 | 8.4 | 0.47% |

| Eurostoxx Index | 3029.0 | 16.1 | 0.54% |

| Oil (WTI) | 34.96 | 0.4 | 1.13% |

| LIBOR | 0.635 | 0.003 | 0.51% |

| US Dollar Index (DXY) | 97.37 | -0.224 | -0.23% |

| 10 Year Govt Bond Yield | 1.87% | 0.03% | |

| Current Coupon Ginnie Mae TBA | 105.4 | ||

| Current Coupon Fannie Mae TBA | 104.6 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.68 |

Stocks are higher this morning as commodities rally and the market anticipates more stimulus from the European Central Bank tomorrow. Bonds and MBS are down small.

Mortgage Applications edged up 0.2% last week as purchases increased 4.2% and refis fell 2.3%. The 30 year fixed rate mortgage rose 6 basis points. We saw a big move up in ARM rates from 3.02% to 3.2%. In an environment where the yield curve is flattening, switching from an ARM to a 30 year fixed is the trade to make.

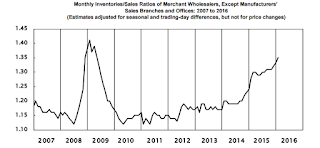

Wholesale sales fell 1.3% last month while inventories built up 0.3%. The inventory-to-sales ratio is 1.35 month's worth, which is the highest since April of 2009. This is a negative sign for the economy going forward, as inventory build adds to GDP, and a buildup essentially "borrows" growth from future quarters. While this number doesn't carry the same weight it did 20 years ago, it still matters.

Consumers are becoming a touch less bullish on future home price appreciation, according to the latest Fannie Mae National Housing Survey. They anticipate that home prices will appreciate 1.7% next year, as opposed to 2.2% last month. We are certainly seeing some signs of softness in the oil states as well as the high end. Their view on the economy is about the most negative it has been since the big equity sell-off in August. 56% believe the economy is on the wrong track, and only 37% believe the economy is on the right track. This statistic explains the appeal of Sanders and Trump these days, two candidates who would ordinarily get zero traction.

Global financial markets are forecasting that the age of ZIRP will be with us for 10 years or more. Sound far-fetched? Japan has been at 0% interest rates for over 20 years. Interest rate cycles are long. While the US may not be in the sort of deflationary trap that Europe and Japan are in, relative value trading will help keep a lid on rates going forward. In fact, the US may be more at risk of future asset bubbles than deflation.

With rates so low, consumers are happy to rack up the credit card debt. The average credit card debt level for a US consumer is $7,879, closing in on the unsustainable levels we saw early in the Great Recession.

No comments:

Post a Comment