| Last | Change | Percent | |

| S&P Futures | 2085.6 | -7.0 | -0.33% |

| Eurostoxx Index | 3671.4 | 2.9 | 0.08% |

| Oil (WTI) | 42.87 | -1.8 | -4.01% |

| LIBOR | 0.269 | -0.001 | -0.30% |

| US Dollar Index (DXY) | 99.08 | 0.530 | 0.54% |

| 10 Year Govt Bond Yield | 1.94% | 0.02% | |

| Current Coupon Ginnie Mae TBA | 103 | 0.0 | |

| Current Coupon Fannie Mae TBA | 102.1 | -0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.82 |

Stocks and bonds are lower after yesterday's furious post-FOMC rally. MBS are flattish.

Initial Jobless Claims rose to 291k from 290k last week. Consumer comfort fell to 51.5 from 54, according to the Bloomberg Consumer Comfort Index. In other economic indicators, the Philly Fed Index was largely flat at 5, while the Index of Leading Economic Indicators was flat at .2%.

The Fed did indeed remove the word "patient" from the FOMC statement. However, they noted that growth moderated, which is unsurprising given the weather in the Northeast. They did take down their economic projections for unemployment, GDP, and inflation. 2015. GDP is now forecasted to be in the 2.3% - 2.7% range, which was revised lower from their 2.6% - 3.0% forecast at the December 2014 meeting. Unemployment was taken down to 5.0% - 5.2% from 5.2% to 5.3% in December, and inflation was taken down to 0.6% to 0.8% from 1.0% to 1.6%.

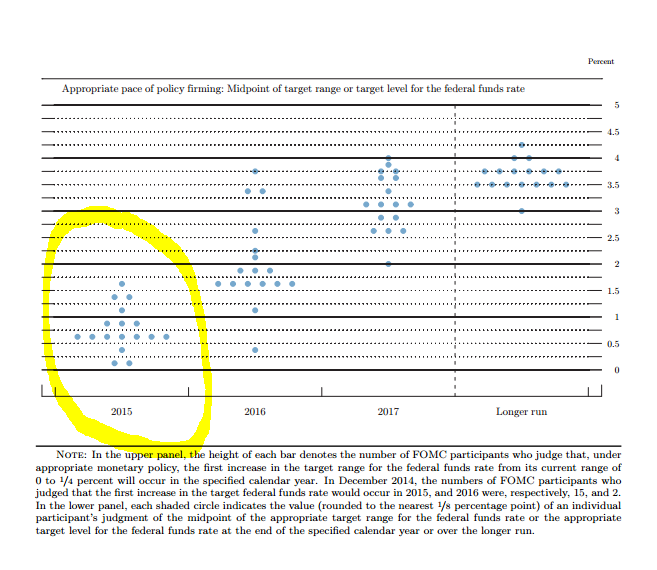

The dot graph was what got the markets all excited. The Fed is forecasting a flatter trajectory to higher rates than they were in December. In the march dot graph, it looks like the median projection by the members is 50 basis points for a year end Fed Funds rate.

Compare that to the December forecast, where the median was closer to 75 basis points or so.

It looks like the 2016 and the 2017 forecasts are slightly lower as well. These dot graphs are what got the market going (although a major bond rally in Europe yesterday probably contributed to the move). Note the makeup of the FOMC is different now than it was in December, and decidedly more dovish. The flatter trajectory for higher rates clearly calmed the markets. The Fed made no change in its plan to shrink its balance sheet. For the time being, they will continue to re-invest maturing proceeds back into Treasuries and MBS.

Stuart Miller, Chief Executive Officer of Lennar Corporation, said, "Despite severe weather conditions which constrained production and sales in parts of the country, the housing market continued its slow and steady recovery. Early signals from this year's spring selling season indicate that the housing market is improving, and disappointing single family starts and permits numbers should rebound shortly. The sizable production deficit of the past years continues to drive demand improvement in spite of the constrained mortgage market."

Lennar will hold a conference call this morning around 11:00 am. The stock is up about a buck and quarter (or about 2.5%).

No comments:

Post a Comment