| Last | Change | Percent | |

| S&P Futures | 1924.7 | -7.4 | -0.38% |

| Eurostoxx Index | 3079.3 | 8.8 | 0.29% |

| Oil (WTI) | 98.13 | -0.2 | -0.16% |

| LIBOR | 0.238 | -0.001 | -0.42% |

| US Dollar Index (DXY) | 81.49 | 0.157 | 0.19% |

| 10 Year Govt Bond Yield | 2.50% | 0.02% | |

| Current Coupon Ginnie Mae TBA | 106.3 | 0.1 | |

| Current Coupon Fannie Mae TBA | 105.5 | -0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.16 |

Markets are lower on no real news. Bonds and MBS are down small.

The ISM Non-Manufacturing Index increased to 58.7 in July, a strong number. In fact, this is the highest reading since inception (with the caveat the index started in Jan 2008). Employment ticked up again, and new orders are accelerating. Prices are not increasing.

Factory orders increased 1.1% as well, but the IBD / TIPP economic optimism index declined.

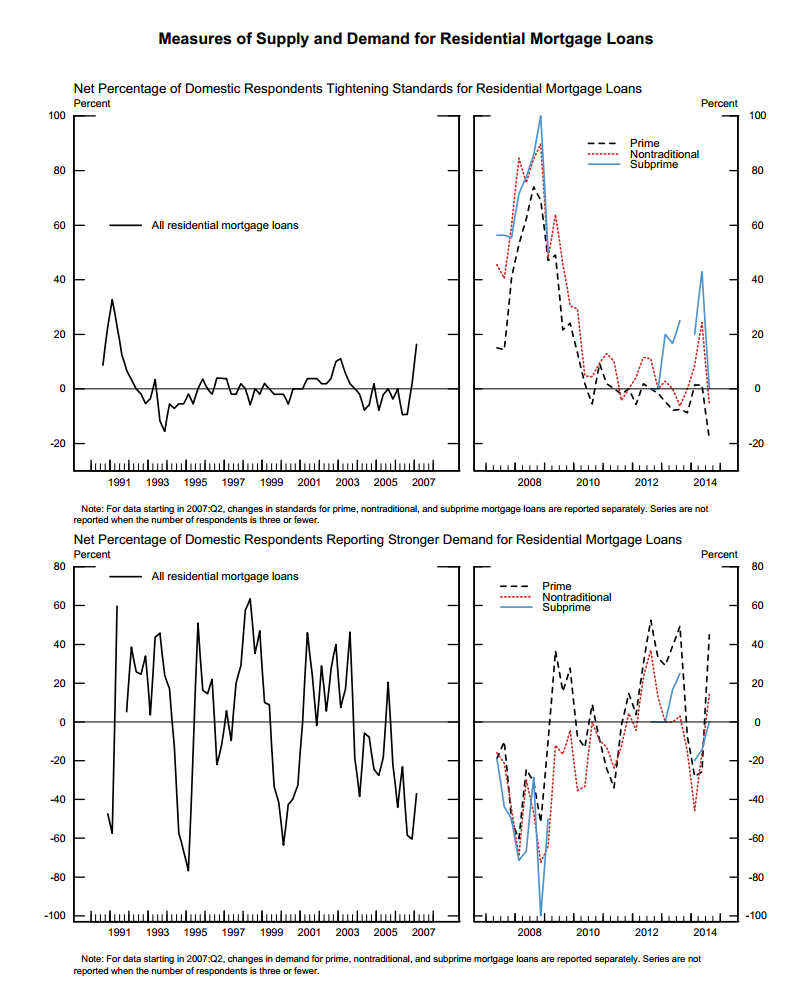

The Fed Senior Loan Officer Survey is out, and it discusses non-QM lending. The majority of banks reported that the rule had no effect on prime conforming mortgages (unsurprising since if it is conforming, it is QM compliant), but about half the respondents indicated QM reduced approval rates on applications for prime jumbo loans and non-traditional mortgages. That said, it is clear from the charts below that credit is easing, and demand is picking up.

Yet another unintended consequence of financial regulation - closing costs for mortgages have increased 6% YOY and in some places are up 20% +.

Home prices are up 1% month-over-month, and are within 13% of their April 2006 peak, according to CoreLogic.

The out-of-office email reply, deconstructed.

No comments:

Post a Comment