| Last | Change | Percent | |

| S&P Futures | 1905.9 | -7.1 | -0.37% |

| Eurostoxx Index | 3035.4 | -36.8 | -1.20% |

| Oil (WTI) | 97.57 | 0.2 | 0.20% |

| LIBOR | 0.237 | -0.001 | -0.42% |

| US Dollar Index (DXY) | 81.62 | 0.294 | 0.36% |

| 10 Year Govt Bond Yield | 2.44% | -0.04% | |

| Current Coupon Ginnie Mae TBA | 106.3 | 0.1 | |

| Current Coupon Fannie Mae TBA | 105.7 | 0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.25 |

Stocks are lower after some bearish economic news out of Europe. Bonds and MBS are rallying. The 10 year bond is right at its May highs.

Mortgage Applications increased 1.6% last week, according to the MBA. Purchases fell 1.3% while refis increased 3.8%. It looks like overall mortgage rates increased 3 basis points or so over the week, while the 10 year was flat. Refis accounted for 55% of all loans, the highest percentage since May.

Wells is getting even more aggressive in the jumbo space. Minimum FICOs for a fixed rate jumbo have been lowered to 700 from 720. They also now do cash-out refis on jumbos and are buying jumbos on second homes on a correspondent basis. This is why the jumbo space is so competitive - banks can subsidize the jumbo mortgage and use that as an opening to pitch other bank services to the customer, particularly asset management.

Walgreen's has decided to not pursue the tax inversion trade after intense political pressure from Washington. They will still purchase the remaining part of Alliance Boots, but will keep their headquarters in Chicago. This change will cost the company about a billion in excess taxes. If I was an arb, I would be nervously looking at my Abbvie / Shire position, and my Covidien / Medtronic positions, which are blowing out this morning.

Corporate inversions are going to be a political football going into midterms. First of all, nobody likes them. Companies don't really want to do them, but they have to honor their fiduciary responsibilities. Politicians on both sides of the aisle despise them. The tax code is going to be changed to prevent them in the future. However, Republicans don't feel much need to negotiate now, as they are pretty much guaranteed to keep the House and may in fact take the Senate. So their negotiating power can only get bigger. The Administration is pushing the "fix the inversion part of the tax code first, and then let's do full tax reform later" argument. Of course Obama knows that he is going to have to trade closing loopholes for lower rates, so he wants to sneak in a freebie before negotiations start. That is a nonstarter for Republicans. Which gives Obama an opportunity to demagogue the issue and paint Republicans as defenders of corporate tax dodgers as the consolation prize.

Arbs are already reeling as Rupert Murdoch withdrew his offer for Time Warner last night. Fox also announced a big buy back, so arbs are getting killed on both sides of the trade. Tough, tough day to be in the risk arbitrage business...

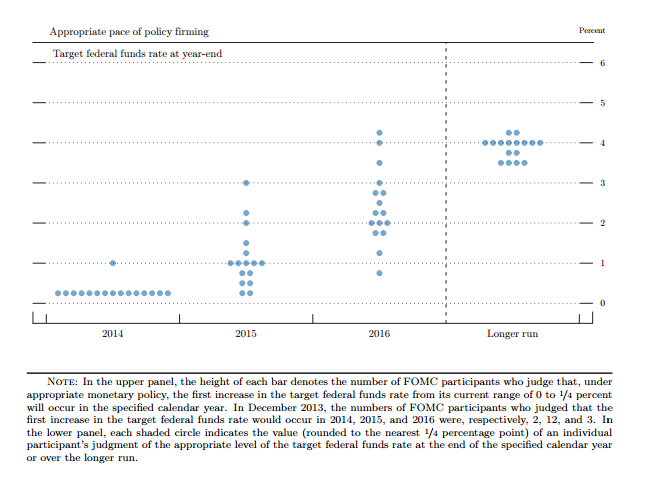

Watch the data. The latest ISM numbers were quite strong, and Dallas Fed President Richard Fisher is predicting that rates will have to increase sooner than it projected in the June dot plot if this economic strength continues. Remember the Fed's "dot graph" - the dots for a tightening will move up. Fisher also said that the debate among the central bankers is "coming in my direction." Bottom line - for the last 6 years you have been able to dismiss the hawks. The ground is shifting.

Counter-argument: The bond market is warning about a slowdown. At least one market strategist thinks the 10 year is heading to 2.2%. True, when the stock market and the bond market disagree, you usually want to side with the bond market. However, you have to keep in mind what is happening overseas and the concept of relative value. The German 10 year Bund yield has hit fresh lows - 1.104%. When rates are falling overseas, they will inevitably drag US Treasuries with them, simply due to relative value. FWIW, I don't think the US bond market is signalling weakness in the US economy. Nor does Goldman.

No comments:

Post a Comment