| Last | Change | Percent | |

| S&P Futures | 1841.6 | 7.3 | 0.40% |

| Eurostoxx Index | 3168.0 | 14.8 | 0.47% |

| Oil (WTI) | 94.59 | 0.2 | 0.23% |

| LIBOR | 0.237 | -0.001 | -0.21% |

| US Dollar Index (DXY) | 81.3 | 0.076 | 0.09% |

| 10 Year Govt Bond Yield | 2.84% | 0.02% | |

| Current Coupon Ginnie Mae TBA | 105.3 | 0.0 | |

| Current Coupon Fannie Mae TBA | 104 | -0.1 | |

| RPX Composite Real Estate Index | 200.7 | -0.2 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.39 |

Markets are flat as the Northeast digs out of a snowstorm. Apparently NYC got hit pretty hard so desks are probably thinly staffed today. Bonds and MBS are down small.

Another day of no economic data, except for mortgage applications, which increased 4.7% last week Purchases dropped 3.6%, while refis climbed 9.9%.

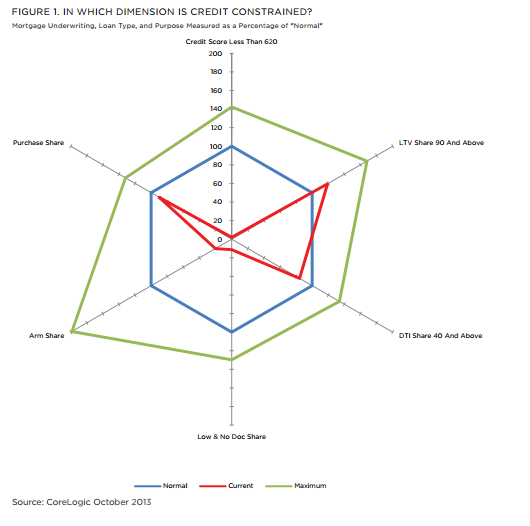

The latest CoreLogic Market Pulse asks where credit is still constrained in the mortgage market. It turns out if you look at the different variables that affect access to credit, low credit scores are the biggest impediment. High LTV loans are actually more prevalent than normal (must be the fact that FHA loans are now a major part of the mortgage market). If you look at the graph below, the red line shows where we are now, the blue line is "normalcy" and the green line is where things got during the go-go days of the bubble.

In the same issue, they say that cash sales made up 37% of total home sales in September. Historically, that number has been closer to 20%. This speaks to the professional investor's presence in the market, which will undoubtedly wane as prices / interest rates continue to climb. Tomorrow we will get existing home sales. The Street is expecting a 4.93 million annualized pace. That works out to about 3.1 million mortgages. If we get back to our historical levels of cash sales, that would equate to 3.94 million mortgages, or a 27% increase in business, even if existing home sales go nowhere. Given that refis are still 64% of all mortgage applications, that won't make up for the loss in refi business, but it does soften the blow a little. Of course there is always the potential for FHFA to tweak the HARP eligibility dates, which would boost refi activity.

Mohammed El-Arian resigned from PIMCO, where he was the heir apparent to Bill Gross. Neel Kashkarian (of TARP fame) resigned as well, and plans to run for Governor of California on the Republican ticket. Bill tweets that he is ready for another 40 years. Good for him - it might be that long until we see another bond bull market.

Wells is selling a $39 billion MSR portfolio to Ocwen. Terms were not disclosed.

No comments:

Post a Comment