| Last | Change | Percent | |

| S&P Futures | 1408.4 | 2.9 | 0.21% |

| Eurostoxx Index | 2598.9 | 8.1 | 0.31% |

| Oil (WTI) | 88.63 | 0.1 | 0.15% |

| LIBOR | 0.311 | 0.000 | 0.00% |

| US Dollar Index (DXY) | 79.79 | 0.142 | 0.18% |

| 10 Year Govt Bond Yield | 1.60% | -0.01% | |

| RPX Composite Real Estate Index | 191.2 | 0.3 |

Markets are higher this morning after China eased investment restrictions on banks and announced measures to promote urban development. Chinese GDP has slowed from close to 9% to 7.5% over the last 9 months. While 7.5% GDP growth sounds impressive, it is back in late '08-early '09 levels. Productivity rose 2.9% in Q3, while unit labor costs fell 1.9%. Bonds and MBS are flattish.

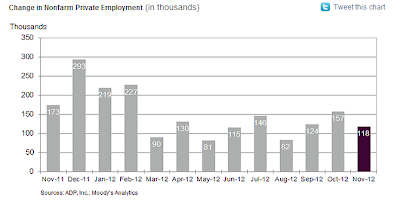

ADP reported a 118k increase in US nonfarm private sector employment for the month of November. This report was obviously driven by Hurricane Sandy. The biggest gains were in construction and utilities, while manufacturing fell. A blip upward in construction and temp workers for storm clean-up and a drop in manufacturing as plants with no power laid off employees. October was revised downward. Mark Zandi estimates that the hurricane depressed employment by 86k.

Edit: Immediately after hitting "post" Citi announces it will cut 11,000 jobs.

Chart: ADP change in non-farm payrolls:

Servicers beware: Not only do you have to fear the CFPB, the state regulators are getting involved. New York State is refusing to approve Ocwen's purchase of Homeward and the servicing unit of ResCap unless the company agrees to bring in a monitor from NY State which would oversee operations for two years and recommend changes in business practices. In all of my years of analyzing mergers and the regulatory process, I have never seen anything like this. Ocwen goes on to point out that they have "not received from any regulator at the federal or state level or any level any findings or evidence we have wrongfully foreclosed on any borrower." This is unprecedented.

The Fed is expected to announce a new round of Treasury buying after Operation Twist ends at the end of the year. US GDP is expected to slow as uncertainty over the fiscal cliff has weighed on capital expenditures and hiring. ML / BOA is forecasting 1% GDP growth in Q4 and Q1.

No comments:

Post a Comment