| Last | Change | Percent | |

| S&P Futures | 1453.8 | 4.6 | 0.32% |

| Eurostoxx Index | 2557.0 | 9.1 | 0.36% |

| Oil (WTI) | 92.48 | 0.4 | 0.42% |

| LIBOR | 0.321 | -0.004 | -1.23% |

| US Dollar Index (DXY) | 78.96 | -0.444 | -0.56% |

| 10 Year Govt Bond Yield | 1.77% | 0.06% | |

| RPX Composite Real Estate Index | 193.3 | -0.1 |

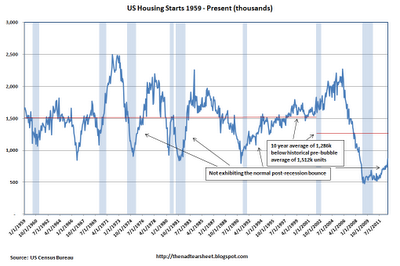

Markets are higher after a strong report on housing starts. The banks reported good numbers while the techs disappointed. Mortgage applications fell, while building permits came in well above expectations. Signs of strength in housing are pushing yields higher on Treasuries and MBS

Housing starts were 872k in September a rise of 15% MOM and 35% YOY. Proportionally, multi-family had the biggest increase, which speaks to the strength in the rental market. While this level is a 4 year high, it still is just about the same level as the nadirs following the 82-82 and 91-92 recessions. So we have a long way to go to get back to "normalcy" which is around 1.5 million, but things seem to be picking up in the housing sector, which has been a major drag on the economy.

Will investors do the heavy lifting of shrinking the TBTF banks? Given languishing stock prices and large discounts to book value, shareholders will be pressuring the banks to exit marginal businesses and either sell them or spin them off to shareholders. For example, Citi's investment banking division is about the size of Goldman Sachs. Goldman trades at an 11 multiple, while Morgan Stanley trades at a 30 multiple. It would make sense for Citi, which trades at a 9.7 P/E to spin off the investment bank, which should unlock shareholder value. Maybe they could resurrect the old Salomon Brothers.

The WSJ was out with a story last night which said the CFPB is considering giving lenders safe harbor if they originate a qualified mortgage. It sounds like this safe harbor wouldn't insulate the banks from buyback risk, but it would insulate them from lawsuits and penalties from the government. If there isn't any protection from buyback risk, I am not sure how much this would end up mattering in the end.

No comments:

Post a Comment