| Last | Change | Percent | |

| S&P Futures | 1442.2 | 1.3 | 0.09% |

| Eurostoxx Index | 2491.1 | -2.5 | -0.10% |

| Oil (WTI) | 91.06 | -0.8 | -0.90% |

| LIBOR | 0.353 | -0.002 | -0.42% |

| US Dollar Index (DXY) | 79.89 | 0.143 | 0.18% |

| 10 Year Govt Bond Yield | 1.62% | 0.00% | |

| RPX Composite Real Estate Index | 194.4 | 0.2 |

Markets are flattish after ADP says US companies added 162,000 jobs in September. This was better than expectations. August was revised downward from 201k to 189k. Mortgage applications rose 16.6% as rates fell. Bonds and MBS are down small.

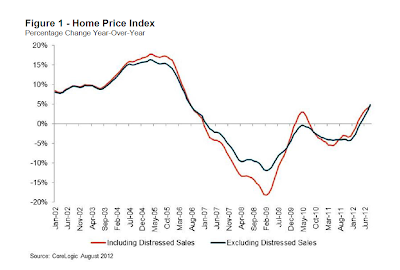

Corelogic reported home prices increased 4.6% in August 2012 compared to August 2011. This was the biggest percentage increase in prices since 2006. All but 6 states reported price gains. They are forecasting a 5% increase for Sep.

While we fret about Europe, the other problem lies across the Pacific - the bursting of the Chinese real estate bubble. The Chinese appear to be at the final phase of the bubble, where the government is hoping that prices simply stagnate for a decade while economic growth and incomes catch up. Unfortunately, experience tells us once bubbles become inflated they take on a life of their own. That said, the Chinese are savers, and have a cushion that US and European households do not.

The Washington Post tries to game the election for the markets. Bottom line: the evidence is mixed, so don't try and trade it. Of course pundits from each political persuasion will try and claim that they are better for the markets. The article ignores the most important consideration (IMO) - An Obama win means the Fed will continue its policy of aggressive quantitative easing. A Romney win means a new Federal Reserve Chairman, and presumably less aggressive measures. So at the margin, an Obama win is bond bullish (or neutral), while a Romney win is bond bearish. I would say that would apply to the stock market as well, at least in the short term. Longer term, the economy will benefit more from less manipulation of interest rates than more. ZIRP is creating imbalances that will create problems down the road.

No comments:

Post a Comment