| Last | Change | Percent | |

| S&P Futures | 1429.1 | 7.6 | 0.53% |

| Eurostoxx Index | 2498.5 | 29.5 | 1.19% |

| Oil (WTI) | 91.96 | 0.1 | 0.11% |

| LIBOR | 0.33 | -0.004 | -1.20% |

| US Dollar Index (DXY) | 79.66 | -0.007 | -0.01% |

| 10 Year Govt Bond Yield | 1.68% | 0.02% | |

| RPX Composite Real Estate Index | 194.1 | -0.3 |

Markets are higher this morning on lower Chinese inflation. Part of the recent strength (it seems like almost every day, the S&P futures are up 5 points pre-open) is being driven by the steady drop in Euro sovereign yields. Italy is trading below 5% and post-re-org Greek debt is trading at 17.5% after reaching 30% in late spring. Whether the crisis is over, or merely taking a breather is anyone's guess. Of course there is the possibility of a hard landing in the emerging markets looming on the horizon.

On the economic news front, retail sales came in at 1.1%, and look even better when you strip out autos and gasoline. Maybe there was something to that University of Michigan consumer confidence number last Friday. It certainly bodes well for a good holiday season for the retailers. On the other hand, the NY Fed's Empire Manufacturing Survey continued to decline.

Citigroup reported better than expected earnings, though it appears one-time items drove the results. The Street is still refusing to give much credit to Citi's turnaround - book value is $63.59 a share and the stock is trading at 35.25, up about a half.

The NY Times has another article discussing the problems with appraisals. Given that the real estate market has been slow for so many years, finding enough non-distressed comps is proving to be a problem. Sellers who think they are lowballing their prices find that appraisals are coming in well below their offers. Appraisers counter that they don't set the market - they reflect it, and blaming appraisers for a lousy housing market is like blaming the weatherman for lousy weather.

Bob Schiller and Rick Santelli discuss ZIRP and housing. Santelli, no fan of ZIRP calls it "money for nothing" and believes that the message it sends (that the Fed is really worried about the next few years) is putting a damper on the animal spirits. Plus, as Schiller has pointed out, there isn't a lot of evidence that mortgage rates explain house prices.

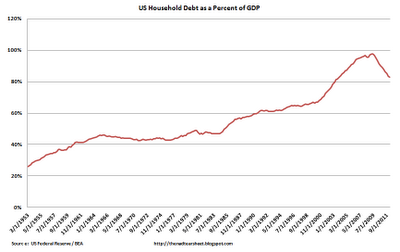

Mark Zandi believes that the deleveraging process is largely over. Certainly debt service payments relative to income are at the lowest level in 20 years, courtesy of low interest rates. Debt however, is not, although it is off the highs of 2007.

No comments:

Post a Comment