Vital Statistics:

|

Last |

Change |

Percent |

| S&P Futures |

1655.5 |

7.4 |

0.45% |

| Eurostoxx Index |

2817.6 |

10.9 |

0.39% |

| Oil (WTI) |

95.88 |

0.7 |

0.76% |

| LIBOR |

0.274 |

-0.001 |

-0.18% |

| US Dollar Index (DXY) |

84.29 |

0.700 |

0.84% |

| 10 Year Govt Bond Yield |

1.90% |

0.02% |

|

| Current Coupon Ginnie Mae TBA |

104.7 |

-0.3 |

|

| Current Coupon Fannie Mae TBA |

103 |

-0.1 |

|

| RPX Composite Real Estate

Index |

198.2 |

0.3 |

|

| BankRate 30 Year Fixed Rate

Mortgage |

3.6 |

|

|

Markets are stronger this morning on good economic data. The University of Michigan Consumer Confidence index rose to 83.7, a post-bubble high and better than expected. Leading Economic Indicators increased .6%, which was better than expected. These should normally not be market-moving indices, but lately stocks can do no wrong and bonds can do no right. The market seems to be convinced that the Fed can stick the landing and end QE without any major hiccups.

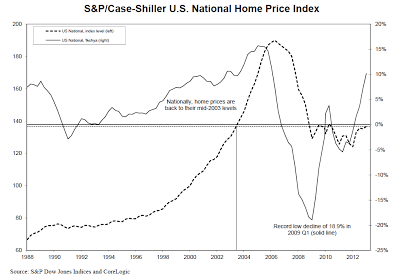

The CoreLogic / Case-Schiller Q412 report is

out. House prices increased 7.3% nationwide in 2012. They are forecasting prices to rise 2.5% in 2013 as the market broadens out from the red-hot Western markets like San Francisco and Phoenix. They see a 5-year annualized trend growth of 3.9%. The areas with the largest price gains: Phoenix (+23,8%), San Jose (+17%), Detroit (+ 16.7%), Miami (+13.5%) and Lost Wages (+13.4%). The biggest declines were in Long Island (-4.3%), Virginia Beach (-2%), Richmond (-1.5%), Philthy (-1.3%) and Birmingham (-1.3%). They do note that the fast-rebounding markets could hit an air pocket as professional investor demand wanes.

They do not see evidence of a new housing bubble. I actually find it humorous that a small rally off the bottom could be considered a "bubble." Bubbles are rare things and are based on an idea that an asset price

cannot go down. We saw that mentality during the late 90s - "Buy quality companies and hold them for the long term. Stocks always go up in the long term. The biggest risk is not being fully invested" People wrote books like

Dow 40,000. Similarly, during the real estate bubble, people thought prices could never fall. People who had no experience in real estate were buying "

Flipping Houses for Dummies." Nobody that experienced the stock market bubble or the real estate bubble is going to believe that these asset prices cannot fall. There may be another stock or real estate bubble, but we won't see it. Maybe our grandkids will.

It was noted at the MBA Secondary conference that private label spreads were widening. We finally see evidence of this with Redwood's

latest private label deal. They just sold $424 million of bonds with the senior tranches priced to yield 2.82%, a spread of 190 basis points over swaps. In January, similar deals were priced at 97 bps over swaps. $5.5 billion of private label deals have been done so far this year, as compared to $3.5 billion for all of 2012. That said, during the bubble, $1.1 trillion of PL securities were issued in one year, so we are still a long way from re-living the salad days of big real estate finance.

The House is holding a hearing this morning on the IRS scandal. Whether this turns into another Watergate or not, the President's political capital is waning quickly. The net effect could be that not much more happens in Washington for the rest of his term. For us, that means replacing FHFA Chief Ed DeMarco with Mel Watt is going to be an even tougher sell, and principal mods for conforming loans / extension of HARP eligibility dates are become less of a sure thing.