| Last | Change | |

| S&P Futures | 2252.8 | 0.8 |

| Eurostoxx Index | 357.0 | 1.3 |

| Oil (WTI) | 50.1 | -0.9 |

| US dollar index | 93.0 | 0.6 |

| 10 Year Govt Bond Yield | 2.58% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.14 |

Stocks are flat this morning after the FOMC meeting yesterday. Bonds and MBS are up small.

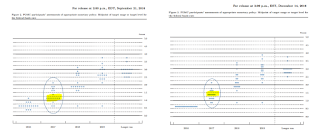

The Fed raised the Fed Funds rate a quarter of a point yesterday as expected, but the dot plot was what garnered all the attention. At the September meeting, the FOMC members were forecasting two more rate hikes in 2017, and now they are forecasting 3. That hit bonds, which sent the 2 year note yield up 12 basis points and the 10 year up 13 basis points. Overall, the language of the statement didn't change much, and neither did the economic forecasts. Aside from a small uptick in their forecast for 2017 GDP growth, most everything else was the same. You can see the change in the central tendency for 2017 in the comparison of the dot plots below. September's plot is on the right, and December is on the left. The yellow line represents the central tendency.

Due to the volatility, most lenders shut down their lock desks, so mortgage rates didn't really move all that much, but expect to see at least some movement, although mortgage rates tend to lag the moves in the 10 year, sometimes quite substantially. The last few tightening cycles have seen a flattening of the yield curve, so an anticipated increase of 75 basis points in the Fed funds rate doesn't necessarily translate into a 75 basis point increase in the 10 year. Mortgage rates will almost undoubtedly increase by less than the increase in the 10 year. And if rates are going up for the right reasons (economic growth) that means the purchase business should offset some of the losses of the refi business.

Janet Yellen's press conference was largely a non-event. She spent it dodging questions about how Donald Trump looks at the world and stressed the Fed will remain data-dependent. The issue of productivity kept coming up, and how Trump will use policies to improve on it (via regulatory reform and corporate tax cutting). Productivity growth should translate into non-inflationary wage growth, which is what everyone is hoping for.

Bottom line: The Fed is going to fade into the background again, and Donald Trump will be driving the news cycle and bond yields. If Congress adds fiscal stimulus, the Fed will probably be more aggressive. Note the dot plot is only a forecast. In fact, many of those dots represent forecasts for people who are not voting members on the FOMC. The Fed might hike 3 times in 2017, but the 10 year yield probably won't go up as much, and mortgage rates will go up even less.

Inflation at the consumer level increased 0.2% last month, and is up 1.7% YOY. The core rate (excluding food and energy) is up 0.2% MOM and 2.1% YOY. Healthcare and rent drove the increase.

We have some manufacturing data as well: Industrial production fell 0.4% MOM and manufacturing production fell 0.1%. Capacity Utilization was flat at 75%. The Philly Fed manufacturing index jumped to 22 from 10 and the Empire State Manufacturing Index improved to 9 from 6. Finally business inventories fell 0.2%.

Initial Jobless Claims fell 4k last week to 254,000. These are the lowest levels since the early 70s.

The median house price rose almost 8% in November, according to RedFin. According to their numbers, the median house price is 274k and months of inventory is 3.4 (meaning they see the inventory situation much tighter than NAR does in their existing home sales report).

No comments:

Post a Comment