| Last | Change | |

| S&P Futures | 2266.5 | 5.5 |

| Eurostoxx Index | 361.3 | 0.8 |

| Oil (WTI) | 52.2 | 0.1 |

| US dollar index | 93.7 | 0.3 |

| 10 Year Govt Bond Yield | 2.55% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.29 |

Stocks are up this morning on no real news. Bonds and MBS are flat.

Pending home sales fell 2.5% in November on rising mortgage rates and tight supply, according to the National Association of Realtors. They forecast existing home sales to hit just over 5.5 million in 2017, which works out to be a 10 year high. NAR anticipates that increasing wages will offset some of the problems with affordability.

Same store sales increased 2.1% last week according to Johnson Redbook. Despite the increases in consumer confidence indices, it doesn't appear to be translating into actual buying.

Bob Shiller (of Case-Shiller fame) thinks that next year could usher in a housing boom, provided some regulatory relief happens. Initially, he thinks that rising rates could accelerate home purchases, as buyers realize that waiting will mean higher house prices and higher rates.

House flippers are making a comeback as well. The number of house flippers has reached a 9 year high, and average profits are up to 61k from 19k at the bottom of the market. About 1/3 are financed with debt, the highest level in 8 years. The market for home flipping loans is still relatively small compared to the vanilla home loan market, but it is expected to reach almost $50 billion this year. The banks don't seem to be making these loans directly, but are lending to smaller finance companies that do. Since these loans are non-owner occupied, a lot of the post-crisis regulations don't apply to them or the companies that make them. Rates are in the 7% - 12% range.

Zillow is predicting a modest slowdown in home price appreciation. They are forecasting a 0.7% increase in November, which works out to be a 5.6% increase YOY. Most analysts are looking for a 3% - 5% increase in house prices for 2017.

Here is a good summary of the various important housing charts, all in one place.

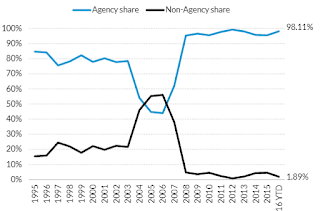

The key to improving housing and mortgage lending next year is to bring back the private label securitization market. You can see below that private label securitization is still way below pre-bubble levels. Increasing interest rates could actually be a help as the risk-reward ratios of home lending decrease, which will bring in more investor money. More regulatory clarity will help issuers.

No comments:

Post a Comment