| Last | Change | Percent | |

| S&P Futures | 1949.8 | -27.4 | -1.39% |

| Eurostoxx Index | 3155.6 | -100.2 | -3.08% |

| Oil (WTI) | 45.32 | -1.6 | -3.37% |

| LIBOR | 0.34 | 0.005 | 1.60% |

| US Dollar Index (DXY) | 94.32 | -0.311 | -0.33% |

| 10 Year Govt Bond Yield | 2.15% | -0.04% | |

| Current Coupon Ginnie Mae TBA | 104.4 | 0.1 | |

| Current Coupon Fannie Mae TBA | 104.1 | 0.2 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.84 |

Stocks are getting crushed this morning after the FOMC decision to not raise rates. Bonds and MBS are rallying.

The index of leading economic indicators rose 0.1% in August.

The Fed maintained rates yesterday, citing concerns over the global economy. Bonds rallied on the news while stocks rallied initially and then sold off. Even the statement was dovish. The new economic forecasts lowered GDP, unemployment, and inflation projections. The dot graph showed FOMC participants are forecasting lower interest rates through 2018 than they were in June. In fact, one participant thinks rates should be lower! Take a look at the dot graph below. Someone is predicting the Fed Funds rate should be negative this year and next. That is new.

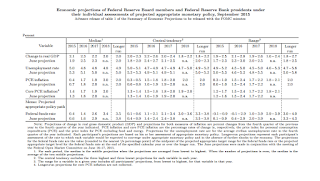

Here are the economic projections:

GDP is lowered, as is unemployment to below 5%. Note the Fed doesn't think it will hit its inflation target of 2% until 2018 (!). To me, this means the Fed is anticipating that the labor force participation rate is going to stay low - that is the only way to explain low unemployment and low GDP. They also seem to think that the overhang of these workers on the sidelines will be enough to keep wage inflation low.

What does that mean for bonds and mortgage rates? If that forecast plays out, you could see short term rates increase and long term rates really not move all that much. To me it means a few more years of mortgage rates right around where they are now. This should be good for housing.

No comments:

Post a Comment