| Last | Change | Percent | |

| S&P Futures | 1960.8 | 10.2 | 0.52% |

| Eurostoxx Index | 3190.2 | 32.9 | 1.04% |

| Oil (WTI) | 45.8 | 1.1 | 2.51% |

| LIBOR | 0.319 | -0.026 | -7.51% |

| US Dollar Index (DXY) | 95.57 | 0.705 | 0.74% |

| 10 Year Govt Bond Yield | 2.17% | 0.04% | |

| Current Coupon Ginnie Mae TBA | 104.6 | 0.2 | |

| Current Coupon Fannie Mae TBA | 104 | -0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.83 |

Stocks are up this morning on no real news. Bonds and MBS are down small.

Existing Home Sales fell 4.8% month-over-month in August. On a year-over-year basis they were up about 4.7%. The median home price rose to $228,700, which puts the median house price to median income ratio over 4x, which is pretty high. The first time homebuyer accounted for 32% of sales, which is an uptick from 28% last month. Inventory continues to be a problem, although it did increase to 2.29 million homes, which represents a 5.2 month supply. A balanced market is about 6 - 6.5 months' supply. Days on market increased to 47 days from 34 two months ago.

Homebuilder Lennar reported earnings that topped estimates this morning. Deliveries were up 16%, while orders were up 20%. Average selling prices were 350k, up 8.9%. Incentives were down to 5.6% from 5.8%. Stuart Miller, CEO characterized the market this way: "During the third quarter, the housing market continued to improve in its slow and steady manner, as demonstrated in the past few years. The new home and rental markets continued to have significant pent-up demand, which positions us well for years to come. This demand is driven primarily by a large production deficit built up over the last several years, an increasing millennial population, reasonable affordability levels and high-rental occupancy rates."

A new Harvard study points out how the rent vs buy decision is becoming even more skewed towards buying as rental inflation continues to increase. The number of US households that spend at least half their income on rent could increase 25% to almost 15 million over the next decade. Note that the homebuilders are pretty much all venturing into multi-family housing as well as single family, which should alleviate this problem at least to some extent. We have had a production deficit for single and multi-fam construction for several years, prices keep rising, and yet housing starts remain at about 75% of normal levels (ignoring the boom and bust years).

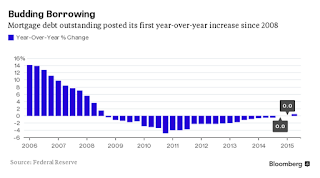

At least one housing statistic is showing signs of returning to normalcy - mortgage debt outstanding is rising again. This was the first gain since 2008. Such an extended contraction in mortgage debt is pretty much unprecedented, at least as far back as the data goes (late 1940s). Of course anyone in the mortgage business could tell you it has been nuclear winter since the crisis began.

Various Fed-heads are still making the case for a December rate hike. Note that the Fed Funds futures contracts are pricing in something like a 50-50 chance for a hike in December. It is kind of hard to reconcile the Fed forecasting sub 5% unemployment and rates pegged to the zero bound.

No comments:

Post a Comment