| Last | Change | Percent | |

| S&P Futures | 1894.9 | 20.4 | 1.09% |

| Eurostoxx Index | 3105.2 | 75.3 | 2.48% |

| Oil (WTI) | 45.02 | -0.2 | -0.46% |

| LIBOR | 0.327 | 0.001 | 0.15% |

| US Dollar Index (DXY) | 96.19 | 0.330 | 0.34% |

| 10 Year Govt Bond Yield | 2.08% | 0.03% | |

| Current Coupon Ginnie Mae TBA | 104.5 | -0.1 | |

| Current Coupon Fannie Mae TBA | 104.2 | -0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.85 |

Stocks are up this morning on no real news. Feels like end of month / quarter window dressing. Bonds and MBS are down small

The economy added 200,000 jobs in September, according to ADP. This is bang in line with the Street estimate for payrolls on Friday. Note that the initial reports of late summer payrolls seem to consistently miss on the downside and are usually revised upward in subsequent months.

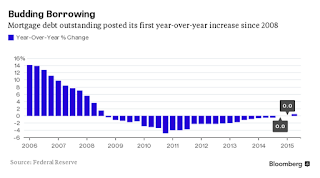

Mortgage Applications fell 6.7% last week as purchases fell 5.6% and refis fell 7.5%.

The ISM Milwaukee index fell to 39.44 from 47.7 last month. The Chicago Purchasing Manager Index fell to 48.7 from 54.4. The strong dollar is taking its toll on manufacturers.

All cash sales dropped to 31% in June, according to Corelogic. The historical, pre-bubble average is close to 25%. This speaks to the lack of first time homebuyers. It also speaks to an increase in gettable loans as that number reverts to the mean, even if home sales remain flat.

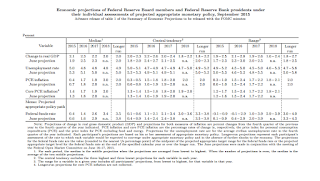

One of the big questions facing the Fed concerns falling unemployment and a falling labor force participation rate. Intuitively, you would think that as unemployment falls, people who are not currently in the labor force but want to be would find jobs, which would push up the participation rate. If the labor force participation rate remains low, that means the potential growth of the economy remains low, which means a slow, plodding recovery that won't feel like any sort of economic boom. It also means inflation should, at least in theory, come back as companies bid up the wages of the fewer workers that are left. So far we aren't seeing that. Millennials should be picking up the slack of retiring boomers but so far it hasn't happened. And if Millennials don't do it, then you need to pick up immigration.

Elizabeth Warren is mad that the government is selling distressed mortgages to hedge funds and private equity firms and wants them sold to non-profit firms. She is of the opinion that hedge funds and private equity firms pursue foreclosure too quickly and said “The heart of it is these loan sales need to come with strings attached with basic outcomes for homeowners.” She is either posing for the cameras or completely uninformed: They do come with strings attached. You usually cannot foreclose for at least a year and must hold the loans for a period of several years.

Heading into campaign season, Americans' trust in the media is at an all time low.