| Last | Change | Percent | |

| S&P Futures | 1664.4 | 13.8 | 0.84% |

| Eurostoxx Index | 2832.8 | 37.8 | 1.35% |

| Oil (WTI) | 95.11 | 1.0 | 1.02% |

| LIBOR | 0.273 | 0.000 | 0.00% |

| US Dollar Index (DXY) | 83.75 | 0.045 | 0.05% |

| 10 Year Govt Bond Yield | 2.05% | 0.04% | |

| Current Coupon Ginnie Mae TBA | 102.8 | -0.3 | |

| Current Coupon Fannie Mae TBA | 101.4 | -0.3 | |

| RPX Composite Real Estate Index | 200.2 | 0.3 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.75 |

Markets are higher after equity markets rally worldwide. Bonds and MBS are down again.

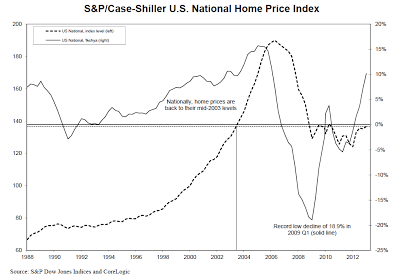

The S&P Case-Schiller House Price Index rose 1.12% MOM and 10.87% YOY in March. This is the biggest gain since April 2006. Gains were widely distributed, with Phoenix rising 22.5% and New York rising 2.6%.

Chart: S&P / Case-Schiller Home Price Index:

Jon Hilsenrath of WSJ discusses the Fed's expectations management issue. The latest FOMC statement inserted language stating that the Fed was ready to increase or decrease purchases as conditions change. During Bernake's testimony, he refused to rule out tapering QE by Labor Day. It feels as if the market expectations and the Fed are not in sync at the moment, which leads to interest rate volatility.

Investors are rotating out of bonds and into balanced funds. Balanced funds will allocate between stocks and bonds and can trade tactically. This could explain some of the "risk on / risk off" behavior we have been seeing. The net result of this could be greater interest rate volatility going forward. After Ben Bernake's comments last week about ending QE this fall, we saw massive selling in the Treasury futures market (something like 250 contracts being sold in a couple minutes) as stocks rallied. If interest rate volatility is the theme of the market going forward, it makes sense to lock and not float.

Title Insurer Fidelity National Financial (FNF) is buying outsourcing / data firm Lender Processing Services (LPS) in a $2.9 billion cash and stock deal.

No comments:

Post a Comment