| Last | Change | |||

| S&P futures | 2698 | 16.25 | ||

| Eurostoxx index | 379.67 | 1.95 | ||

| Oil (WTI) | 66.26 | 0.05 | ||

| 10 Year Government Bond Yield | 2.83% | |||

| 30 Year fixed rate mortgage | 4.44% | |||

Stocks are higher this morning as China relaxes ownership restrictions on domestic manufacturers. Bonds and MBS are flat.

We have a lot of Fed-speak today, especially in the morning. Separately, Trump announced two Fed nominees: Richard Clarida of Columbia, to be the Vice Chairman of the Fed and Michelle Bowman, previously a bank executive from Kansas. For all of his criticism of the Fed while on the campaign trail, Trump has nominated pretty much middle-of-the-fairway people to the Board.

Housing starts came in at 1.32 million, better than expectations but still well below what is needed to meet demand. Building Permits came in at 1.35 million. Single family starts fell, while multi rose. Most of the increase was in the Midwest.

Industrial Production rose 0.5% last month, while manufacturing production rose 0.1%. Capacity Utilization increased to 78%. So far we aren't seeing any tariff effects in the numbers.

Bank of America announced earnings yesterday, and lumped mortgage banking income into the miscellaneous "all other income" category. What an ignominious end to Countrywide. Bank earnings season continues.

Independent mortgage bankers saw profit per loan get cut in half last year as refis dried up and the business got more competitive. Refis fell from 36% of all origination volume to 25%.

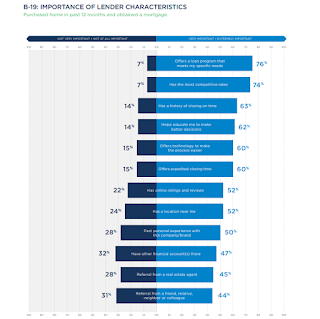

Zillow crunched the numbers and looked at the typical homebuyer in 2017. The typical buyer is 40 years old, making 87k. Millennials make up 42% of the cohort. They typically spend about 4.3 months finding a home. Interestingly, despite the size of the investment, most homebuyers only contacted 1 lender. Here is what is important to homebuyers when thinking about a lender:

The median home was sold in 81 days, and that includes the closing process. This means the typical home was on the market for only 1 month. This is 8 days faster than 2016.

The National Low Income Housing Coalition has a new report showing how acute the housing shortage is at the low end. Only 35 affordable

and available rental homes exist for every 100

extremely low income renter households. Rising home prices and mortgage rates are reducing affordability, however interest rates are still extremely low historically. In the early 80s, a the first year's mortgage payment consisted of 99% interest, 1% principal.

The IMF forecasts that global growth will hit 3.9% this year, the fastest since 2011, driven by emerging Europe, and the US.

No comments:

Post a Comment