| Last | Change | |||

| S&P futures | 2701.75 | -8 | ||

| Eurostoxx index | 381.94 | 0.11 | ||

| Oil (WTI) | 69.26 | 0.79 | ||

| 10 Year Government Bond Yield | 2.90% | |||

| 30 Year fixed rate mortgage | 4.44% | |||

Stocks are lower as commodities surge. Bonds and MBS are down.

The US imposed sanctions on Russia's Rusal, which has sent aluminum prices up 30% and nickel to 3 year highs. This has the potential to spill through to finished products and bump up inflation. As a general rule, commodity push inflation generally isn't persistent. An old saw in the commodity markets: the cure for high prices is... high prices.

Initial Jobless Claims ticked up to 232,000 last week, still well below historical numbers.

Investors are starting to worry about the inverted yield curve. An inverted yield curve (where short term rates are higher than long term rates) has historically signaled a recession. The spread between the 10 year and the 2 year is around 41 basis points, which is a 10 year low. Is that what the yield curve is telling us now? I would answer this way: the yield curve is so manipulated by central banks at the moment, that the information it is putting out should be taken with a boulder of salt. We are in uncharted territory, where long term rates are no longer set purely by market forces.

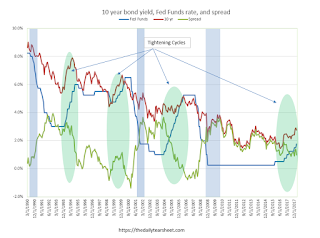

Also, take a look at the chart below, where I plotted the last 4 tightening cycles. In the last 2 cycles, the yield curve inverted, by a lot. In late 2000, the yield curve inverted by 100 basis points - that would be like the Fed taking the FF rate up to 4% while the 10 year hovers around here - at 3%. I would note that the mid 90s tightening cycle didn't cause a recession, and the late 90s and mid 00s tightening cycles didn't result in recessions immediately - it took years before the economy entered into a recession.

The question is whether the Fed caused these recessions. It is possible, and the Fed was probably the catalyst to burst the late 90s stock market bubble and the mid 00s real estate bubbles. But these were going to burst anyway. It doesn't really matter what the catalyst is. This time around, we don't really have a similar bubble - we may have pockets of overvaluation, but we don't have bubbles that the typical American is invested heavily in. Not like stock or houses. I think the Fed is happy to gradually get off the zero bound and once we are at 3% on the Fed funds rate will be content to stop. I could see the 10 year going absolutely nowhere during that time.

My take is this: take the shape of the yield curve as a very weak and distorted economic signal - the labor data will tell you what is really going on, and the labor data is signalling expansion, not recession.

Don't forget that bond rates are set in a global market, and relative value trading between sovereign bonds will play a role. The US 2 year is at a multi-decade premium to the German 2 year, and in theory, that should mean that investors sell Bunds to buy Treasuries. The reason why that isn't happening? The US dollar, which isn't buying the Administration's rhetoric.

Facebook wants to get into the semiconductor business. Really. First Zillow wants to get into the house flipping business and now this. I don't understand why companies with great business models want to dilute them. Both companies have a competitive moat with a largely recession-proof business model. The semiconductor business is one of the most cutthroat, lousy businesses this side of refineries and airlines. Take a look at QCOM today.

The NAHB remodeling index dipped in March, driven by bad weather in the Northeast and the Midwest. With home affordability slipping due to higher interest rates and home prices, remodeling remains a good substitute for moving up.

No comments:

Post a Comment