| Last | Change | |

| S&P Futures | 2281.3 | 4.5 |

| Eurostoxx Index | 364.1 | 2.2 |

| Oil (WTI) | 53.8 | 0.2 |

| US dollar index | 90.6 | 0.1 |

| 10 Year Govt Bond Yield | 2.47% | |

| Current Coupon Fannie Mae TBA | 102.1 | |

| Current Coupon Ginnie Mae TBA | 103.2 | |

| 30 Year Fixed Rate Mortgage | 4.19 |

Stocks are up after a decent jobs report. Bonds and MBS are up as well.

Jobs report data dump:

- Nonfarm payrolls up 227,000

- 2 month prior revision down 39,000

- Unemployment rate 4.8%

- Underemployment rate 9.4%

- Labor force participation rate 62.9%

- Average hourly earnings up 0.2% MOM / up 2.5% YOY

Overall, a pretty decent report. Payrolls were much better than expectations, although the downward revision of 40,000 to November offset that somewhat. The employment to population ratio ticked up from 59.7 to 59.9, which is something the Fed pays close attention to. The year-over-year increase in wages took a step back, but part of that is due to very strong January 2016 number which fell off the YOY comparison. In terms of industries, we saw big increases in construction and retail. The oil patch is hiring again as well. In some ways this was a Goldilocks type report: strong enough to make the stock market happy, and weak enough in wage growth to keep bonds from selling off.

The ISM non-manufacturing index took a step back in January from December's strong pace. Factory orders increased 1.3%.

President Trump has ordered a comprehensive review of Dodd-Frank and suspended Obama's fiduciary rule executive order which was to take effect in April. The goal of the review is to remove regulatory burdens to the financial industry and to increase investor options, according to an administration official. Areas of focus include reforming the CFPB, the Volcker rule, and the fiduciary order. Critics claim that the CFPB is restricting credit, the Volcker rule is restricting liquidity in the markets, and the fiduciary rule amounts to a gag order for retirement advisors.

US CEOs are meeting with Donald Trump today, as the relationship between the two becomes more tenuous. The problems are twofold. First, the left is organizing boycotts on any company associated with the Trump administration, while culminated in Uber's CEO resigning from Trump's business panel after the #deleteUber campaign. Second, fears of immigration limits are worrying many, particularly in the tech space. Finally Trump's naming and shaming of companies via Twitter is causing uncertainty as well.

Interesting article in the Wall Street Journal about the future of the labor market and the business world's continued move towards outsourcing, even within the US. Companies like Pratt and Whitney are now using UPS to handle parts of the logistics chain that used to be done by Pratt and Whitney employees. This obviously gives the company more flexibility and they don't have to deal with the HR issues of hiring and firing. Temporary worker agencies continue to grow and allows companies to have "just in time" employee management. Accenture sees a future where the only full time employees at some companies are C-level: the rest will be temps. I wonder if it will work out the way these companies imagine however. Once these agencies control vast parts of the company's operations, the agency will be able to hold up a company for higher rates the way unions used to hold up companies for higher wages.

Freddie Mac has a somewhat gloomy outlook for origination next year, forecasting a drop of 25% from 2016's level of $2 trillion in origination. They see the 30 year mortgage rate averaging 4.4% and total home sales falling from 6 million to 5.75 million. House price growth is expected to moderate to 4.7% from 6%. Freddie Mac is baking in some possibility of expansionary fiscal policy coming out of Washington, especially with respect to tax reform, where an increase in the standard deduction will reduce the incentive to itemize and reduce the subsidy from the mortgage interest deduction. They do point out that increases in interest rates have been generally short-lived over the past 8 years as slow global growth and excess savings find their way into the bond market. Freddie Mac caveats this outlook with the fact that the new administration provides a lot of uncertainty. FWIW, it is looking like it will take 60 votes to get anything done in the Senate, which means a fiscal status quo. That will likely mean only 2 hikes in 2017, not 3. Rates may not be going up as much as people think.

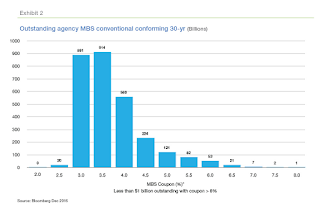

You can see the refinanceable population has decreased significantly as rates have risen:

No comments:

Post a Comment