| Last | Change | |

| S&P Futures | 2291.5 | 5.0 |

| Eurostoxx Index | 363.3 | 1.7 |

| Oil (WTI) | 52.7 | -0.4 |

| US dollar index | 90.9 | 0.6 |

| 10 Year Govt Bond Yield | 2.43% | |

| Current Coupon Fannie Mae TBA | 102.1 | |

| Current Coupon Ginnie Mae TBA | 103.2 | |

| 30 Year Fixed Rate Mortgage | 4.13 |

Stocks are up this morning on no real news. Bonds and MBS are down small.

Job openings were largely unchanged MOM at 5.5 million, according to the BLS's JOLTS report. On a year-over-year basis, they were up 4.2%. Hires ticked up slightly, while separations fell. The quits rate ticked down to 2.0% from 2.1% in November and 2.2% last year. This will give some comfort to bond investors as well as the Fed, as an increase in the quits rate usually leads an increase in wage growth.

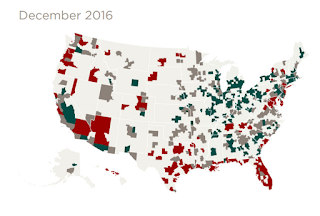

Home prices rose 0.8% MOM and are up 7.2% YOY according to CoreLogic. They foresee a deceleration of home price appreciation in 2017, with a 4.7% increase. The action was in the Pacific Northwest and Mountain states, with Washington, Idaho, Oregon, Colorado, and Utah leading the charge. Here is a map of the overvalued (red) and undervalued (green) MSAs:

Rising home prices and mortgage rates have hit affordability, which is the lowest in 7 years, when you use the metric of mortgage payment on the median house to median income ratio. Much of the hit took place towards the end of last year as as rates spiked post-election. Tight inventory is driving the price increases, not incomes, which means current prices are vulnerable if wages don't increase. Eventually builders will start more construction, but as of now they are still holding back.

Economic confidence improved last week according to the Gallup Economic Confidence Index. January was the highest month since 2008. More people are feeling engaged at work, but future expectations drove the index. Despite all the sturm and drang out of Washington, Americans are shrugging it off. Other indices like the VIX, as well as gold prices (despite what the article below says) are confirming this. Separately, Fannie Mae's Home Purchase Sentiment Index improved two points last month. Most notable in that survey: the net share of people reporting significantly higher household income growth in the past 12 month increased by 5 percentage points. Also, bankruptcy filings are the lowest since 2006.

On the other hand, Washington insiders and journalists (especially) are not feeling that way. Donald Trump has upset the traditional way things are done, and that has a lot of pros spooked. That said, I think creating a confidence index based on the use of the word "uncertainty" in business articles speaks more towards the predilections of journalists than it does to the markets as a whole.

Fixing Dodd-Frank will take some time, along with repealing and replacing Obamacare. Democrats are vowing to go to the mattresses on both, although I think Obamacare will be where the war is going to be fought. As I have said before, I suspect there is enough bipartisan agreement to do something on Dodd-Frank, at least with regards to small bank regulation. Reforming the CFPB is expected to cleave down partisan lines, although the Courts may be forcing Congress's hand there. Much of the change is going to be done non-legislatively, in how the agencies interpret and enforce the law. Democratic Party priorities like disclosing the pay difference between CEOs and the rank and file are simply going to go by the wayside.

Rob Chrisman mentioned iServe in this morning's blog, talking about our own John McDade's VA tour, where he visits our branches and talks about what a great product the VA loan is.

No comments:

Post a Comment