| Last | Change | Percent | |

| S&P Futures | 2081.0 | -18.8 | -0.90% |

| Eurostoxx Index | 3619.3 | -55.6 | -1.51% |

| Oil (WTI) | 43.62 | -1.3 | -2.98% |

| LIBOR | 0.312 | 0.000 | 0.06% |

| US Dollar Index (DXY) | 96.98 | -0.181 | -0.19% |

| 10 Year Govt Bond Yield | 2.16% | -0.07% | |

| Current Coupon Ginnie Mae TBA | 104.2 | -0.2 | |

| Current Coupon Fannie Mae TBA | 103.6 | 0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.91 |

Markets are lower this morning after China devalued the yuan overnight. Bonds and MBS are up.

Wholesale inventories rose 0.9% in June, while wholesale sales rose only 0.1%. The ratio of inventories to sales rose to 1.3. This is a worrisome signal. A rising inventory to sales ratio is a harbinger of a cyclical recession. While there is a possibility that the West Coast Port strike from earlier this year is messing with the data, the trend is unmistakable.

Productivity rose less than expected in the second quarter, and unit labor costs were higher than expected, which was disappointing. The first quarter numbers were revised better (productivity up and unit labor costs down), however Q1 productivity was still flat and unit labor costs were higher than inflation. These two numbers can be volatile, so it makes sense to look at a moving average. The 12 month moving average for productivity is about 0.25%. The 12 month MA for unit labor costs is about 2.1%. Anyway, flat productivity and 2% wage inflation is not symptomatic of a great labor market, despite what the numbers say.

Small business optimism rose in July, according to the NFIB. Expectations for the economy accounted for about half the rise. Employment was flat. Increasing labor costs (not only wages, but regulatory burden) are depressing the bottom line as profits fall. In fact, most are reporting that the increase in labor costs is due to mandated benefits, not wage increases. This again speaks to the bifurcated market: the big S&P 500 companies are doing well, but much of that is due to (a) rock bottom interest rates and (b) overseas exposure. Those circumstances don't really apply to the local dry cleaner. Which is why liberals can claim: "These hugely profitable companies refuse to pay a "fair" wage" and conservatives can claim "Regulation is strangling small business and those costs are manifested in stagnant wages." Liberals are focusing their ire at the big multinationals and conservatives focus their ire at government. There is a bit of truth in both viewpoints.

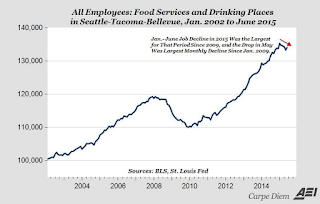

Speaking of regulations, the American Enterprise Institute crunched the numbers and it turns out that Seattle lost about 1,300 jobs from Jan - June. Of course it is still early days, but it looks like the laws of supply and demand are still applicable in the labor market, regardless of what politicians think.

Completed foreclosures fell to 43k in June, according to CoreLogic. This is up 4.8% from May but down 14.8% from a year ago. The foreclosure inventory remains the highest in the Northeast, where the judicial states are still working through their backlog.

Google is now going to be known as Alphabet. They are re-organizing into a holding company structure. The Street seems to like it.

No comments:

Post a Comment