| Last | Change | Percent | |

| S&P Futures | 1886.3 | 10.0 | 0.53% |

| Eurostoxx Index | 3146.7 | 2.2 | 0.07% |

| Oil (WTI) | 102.1 | 0.5 | 0.49% |

| LIBOR | 0.236 | 0.001 | 0.23% |

| US Dollar Index (DXY) | 79.75 | 0.090 | 0.11% |

| 10 Year Govt Bond Yield | 2.80% | 0.06% | |

| Current Coupon Ginnie Mae TBA | 105.7 | 0.0 | |

| Current Coupon Fannie Mae TBA | 104.1 | -0.3 | |

| RPX Composite Real Estate Index | 200.7 | -0.2 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.39 |

Markets are higher after a stronger-than-expected jobs report. Bonds and MBS are getting slammed.

Data Dump from the jobs report

- Feb payrolls up 175k (149k exp)

- Two month revision 25k

- Unemployment rate ticks up to 6.7%

- Average Hourly earnings up .4% (.2% expected)

- Average weekly hours dropped to 34.2

- Labor force participation rate steady at 63%

The tick up in the unemployment rate means that discouraged workers are beginning to start looking for jobs again. Overall, it was a decent report. It won't change the Fed's posture by any means, but it shows the labor market is gradually becoming more balanced.

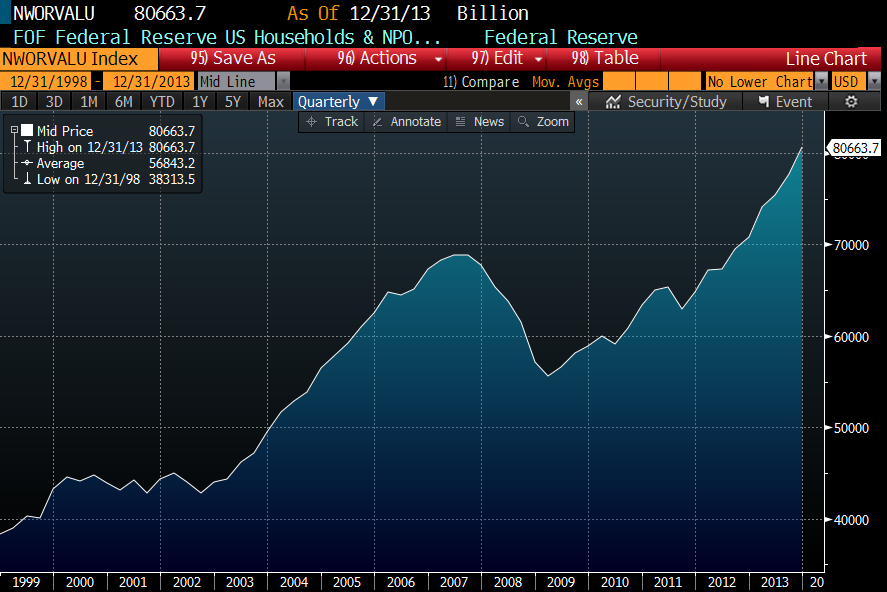

Yesterday, we got the household net worth numbers out of the Fed. Net worth increased almost 4% quarter-over-quarter and 14% year-over-year. This shows a lot of the Great American Deleveraging is behind us.

One thing to keep in mind however, is that this increase in net worth has been driven primarily by asset price inflation. If you look at aggregate household debt over the same period, it has fallen, but not dramatically.

What this shows is that it is imperative that the Fed stick the landing with respect to exiting QE and normalizing interest rates. If asset prices (houses, stocks) fall as rates increase, it will undo a lot of the progress that has been made, and will probably be recessionary.

No comments:

Post a Comment