| Last | Change | Percent | |

| S&P Futures | 1701.3 | 9.3 | 0.55% |

| Eurostoxx Index | 2999.1 | -5.5 | -0.18% |

| Oil (WTI) | 101 | -0.2 | -0.24% |

| LIBOR | 0.246 | 0.003 | 1.03% |

| US Dollar Index (DXY) | 80.32 | -0.164 | -0.20% |

| 10 Year Govt Bond Yield | 2.74% | 0.01% | |

| Current Coupon Ginnie Mae TBA | 105 | -0.2 | |

| Current Coupon Fannie Mae TBA | 104.1 | -0.1 | |

| RPX Composite Real Estate Index | 200.7 | -0.2 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.33 |

Markets are higher this morning on optimism that a deal is unfolding in the Senate. Bonds and MBS are down. The Mortgage Bankers Association reported that applications increased .3% last week.

Last night, Fitch put US sovereign debt on rating watch negative. "Although Fitch continues to believe that the debt ceiling will be raised soon, the political brinkmanship and reduced financing flexibility could increase the risk of a U.S. default"

Harry Reid and Mitch McConnel are finalizing plans to raise the debt ceiling through Feb 7 and fund the government through Jan 15. Technically the government runs out of money tomorrow, however independent analysts say that the real D-day is November 1. Note that T-bills maturing Oct 31 are trading with a yield of 36 basis points, which means the market is discounting the possibility that they get paid late. Both sides have been making small concessions to get a deal done. Of course the wild card is the House, and whatever solution that comes out of the Senate will leave obamacare largely intact. Note, as I write this, Bloomberg is saying that the T-bills maturing 10/31 now yield 52 basis points.

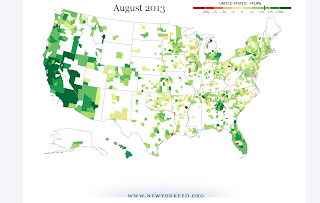

The dog that didn't bark - shadow inventory. People have been warning of mass dumping of REO properties, but it never occurred, and now shadow inventory is working its way down. Regulators never forced the banks to write down / dispose of bad assets like they did after the S&L crisis in the late 80s. Billions of dollars were raised to capitalize on this, and the flow has been a slow trickle. Second, judges have been slow to approve foreclosures, particularly in the Northeast. This explains the wide disparity between home price appreciation in the West, where the shadow inventory has largely been worked off and the Northeast.

Bank of America announced 3Q earnings this morning, and came in better than expected. The pipeline ended the quarter down 59% quarter on quarter. Production was $465m vs $860 in Q2 based on lower gain on sale margins and a reduction in rate lock volume. 78% were refis.

No comments:

Post a Comment