| Last | Change | Percent | |

| S&P Futures | 1454.8 | 3.4 | 0.23% |

| Eurostoxx Index | 2553.3 | -4.6 | -0.18% |

| Oil (WTI) | 92.97 | 1.0 | 1.13% |

| LIBOR | 0.364 | -0.004 | -1.02% |

| US Dollar Index (DXY) | 79.5 | -0.015 | -0.02% |

| 10 Year Govt Bond Yield | 1.71% | 0.00% | |

| RPX Composite Real Estate Index | 194.5 | -0.2 |

Markets are up slightly on no real news. Caterpillar issued a profit warning based a drop in capital expenditures from the miners, which is a bad sign for the world economy, particularly China. Nevertheless, commodities are up this morning. Bonds and MBS are up small.

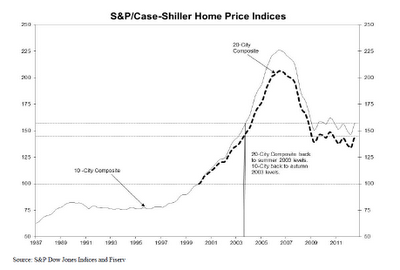

The S&P / Case-Schiller index showed a 1.2% annual increase in July. They note the recent strength of the housing market and that inventory is down. FWIW, the strategist at Radar Logic (the publisher of the RPX index) believes the strength is a head fake due to the large amount of shadow inventory. One big question regarding shadow inventory is how much has been picked over? Is the remaining shadow inventory the least salable garbage that nobody wants? If so, will its liquidation matter that much to prices? How much of it is vacant dilapidated blight in places like Detroit and Toledo, which will never sell and will probably get demolished?

Chart: Case-Schiller:

The Romney campaign has released its plan for the housing market. The most significant departure from the Obama administration is an end to REO-to-rentals. A President Romney, observing that a ton of money has been raised to invest in resi, would simply sell the property as opposed to using various strategies like REO to rental to keep it off the market. He would end TBTF Fan and Fred (he doesn't say how) and he would usher in "sensible, but not overly complex financial regulation to allow banks to approve loans to families with good credit rather than rejecting their mortgage applications." I take it the last statement means we will finally learn what the government considers a "qualified mortgage." Basically, the plan boils down to "hit the bid, stop trying to manipulate the real estate market, and make some decisions on how we are going to regulate the banks."

RBS has been implicated in the LIBOR scandal, along with Barclay's. This time, it looks like RBS was not simply falsely reporting LIBOR during the financial crisis to prevent a bank run, it was doing it over a longer period to benefit positions. Regulators might let the first case slide; they certainly won't let the second one.

Yet another unintended consequence of ZIRP - the death of the "free" checking account.

No comments:

Post a Comment