| Last | Change | |||

| S&P futures | 2728.75 | 9.5 | ||

| Eurostoxx index | 379.91 | 3.04 | ||

| Oil (WTI) | 73.39 | -0.06 | ||

| 10 Year Government Bond Yield | 2.84% | |||

| 30 Year fixed rate mortgage | 4.52% | |||

Stocks are higher this morning on end-of-quarter window dressing. Bonds and MBS are flat.

Personal incomes rose 0.4% in May while personal spending rose 0.2%. Incomes were in line with estimates, while spending was lower. The June FOMC statement said that consumer spending was accelerating - no evidence of that in this report. Services spending drove the decline, and we could be seeing evidence that higher gasoline prices is affecting discretionary expenditures. Inflation was in line with expectations at the MOM level, and a hair above expectations on an annual basis. The core PCE index ex-food and energy came in at 2%, which is right where the Fed wants it. April's income and spending numbers were revised downward. Don't be surprised if strategists take down some of their Q2 GDP forecasts on these numbers.

The Chicago PMI improved to 64 from 62, which is a 5 month high. New Orders and order backlog drove the increase. We are seeing some signs of inflation brewing, with extended lead times, and a 7 year high on the prices paid index. Businesses were asked about how trade was affecting their operations. About 25% said they were having a significant impact, 40% said there was a minimal impact, and the rest were either unsure or insulated from trade issues.

KB Home reported strong numbers, with a 170 basis point increase in gross margins, 10% revenue growth, and a 50% increase in operating income. ASPs were up 4% to 401,800, and order growth was 3%. Backlog was the second highest on record. The stock is up 7% pre-open.

Interesting theory about the lack of construction workers: opiods. Between users and those that have been convicted of crimes related to usage, many workers are shut out of the work force. 80% of homebuilders report shortages in subcontractors.

The Senate will hold hearings on July 12 and 19th for Kathy Kraninger's nomination to run the CFPB. The conventional wisdom is that she is not intended to be confirmed, but is to be an excuse to keep Mick Mulvaney in charge of the agency.

Deutsche Bank failed its stress test, while State Street, Goldman and Morgan Stanley got dinged.

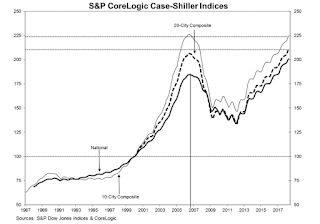

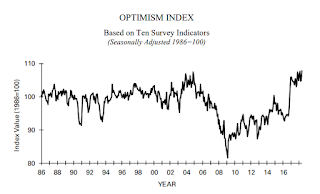

Many Millennials are struggling to get a down payment for a home, and now some companies are working to help them get it. One company will supply up to a $50,000 downpayment if the borrower rents out a room on Air B&B and shares the income with the company. These loans are appealing to borrowers who might qualify for a FHA or 3% down Fannie loan but don't want to pay the MI and other costs. While there are fears that we are bringing back the bad old days of the real estate bubble, here is the MBA's mortgage credit availability index. We are a long way away from the days of the pick-a-pay mortgage.