| Last | Change | |||

| S&P futures | 2789 | 2.25 | ||

| Eurostoxx index | 387.87 | -0.07 | ||

| Oil (WTI) | 66.04 | -0.06 | ||

| 10 Year Government Bond Yield | 2.98% | |||

| 30 Year fixed rate mortgage | 4.59% | |||

Stocks are higher this morning on reports of an agreement with North Korea. Bonds and MBS are down.

The FOMC meeting begins today. The Fed Funds futures are handicapping a 91% chance of a rate hike tomorrow.

Trump and Kim signed an agreement to denuclearize the Korean Peninsula. There is no timetable, but not much in the way of concrete agreements, however Trump did pledge to end military exercises with South Korea.

Inflation at the consumer level remains under control, as the Consumer Price Index rose 0.2% MOM / 2.8% YOY. The core rate rose 0.2% MOM / 2.2% YOY. These numbers were all in line with street estimates. Aside from energy, healthcare costs (hospital, Rx) drove the increase.

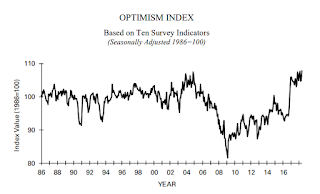

Small business optimism remains strong, as the NFIB index hit its second highest level in its 45 year history. Compensation increases hit a 45 year high as a net 35% of small businesses increased wages. 58% of employers reported openings, but half couldn't find qualified applicants. I will say this again, I suspect the biggest culprit in the "labor shortage" is the plethora of application tracking systems which pre-screen job applications. They may have been a help during the days of high unemployment when finding the right employee was like finding a needle in a haystack. Nowadays, they the computer systems are probably screening out potential fits before anyone gets to see the resume. There are all sorts of articles about how these systems have to be gamed, and most people probably don't.

The strong economy and good home price appreciation are contributing to a drop in delinquencies, according to CoreLogic. 30 day DQs dropped by 10 basis points to 4.3% in March. The foreclosure rate fell from 0.8% to 0.6%. In the first quarter, the typical homeowner saw a $16,300 increase in home equity.

Declining margins has lenders bearish, according to the latest Fannie Mae lender sentiment survey. "Lenders remain bearish this quarter as they continue to face headwinds from rising mortgage rates, tight supply, and strong home price appreciation, which have drastically reduced refinance activity and restrained home purchase affordability," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "These factors have combined to squeeze mortgage origination volumes and have increased competitive pressures. Increased competitiveness will likely persist as a top driver of lenders’ mortgage business strategy. We expect this will prompt businesses to turn to cost-cutting as a means of managing their bottom lines, with payroll reduction likely to assume a more prominent role in future belt-tightening efforts."

No comments:

Post a Comment