| Last | Change | |

| S&P Futures | 2727.3 | 9.0 |

| Eurostoxx Index | 373.3 | 2.4 |

| Oil (WTI) | 63.1 | 0.5 |

| US dollar index | 83.5 | -0.3 |

| 10 Year Govt Bond Yield | 2.89% | |

| Current Coupon Fannie Mae TBA | 102.25 | |

| Current Coupon Ginnie Mae TBA | 102.5 | |

| 30 Year Fixed Rate Mortgage | 4.4 |

Stocks are higher this morning on no real news. Bonds and MBS are down.

The EU proposed tariffs on some US goods if Trump follows through on his plan to institute higher tariffs on steel and aluminum imports. White House Gary Cohn is working with business leaders in an attempt to change the President's mind. Think about that. An economic advisor is reaching out to administration outsiders to try and get the President to change his mind. Imagine Austan Goolsbee soliciting the input of the financial industry in 2009 in an effort to derail Dodd-Frank. Supposedly Cohn plans to resign if Trump doesn't relent on a trade war. House Speaker Paul Ryan has also come out against tariffs. Despite Trump's warning that he "won't back down" on tariffs, the markets are starting to bet that a trade war isn't going to happen, which is probably why futures are up.

Don't forget that we already have tariffs on Canadian softwood lumber. Prices are at record levels. This is yet one more reason why we have such an affordability problem - not enough (cheap) new construction.

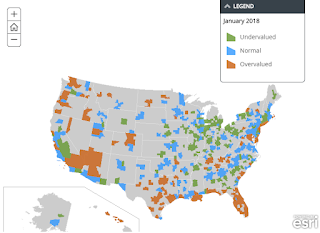

House prices rose 0.4% MOM from December to January, according to CoreLogic. Prices are up 6.6% YOY. They are forecasting prices to rise 5% this year. The fastest appreciation is at the lower price points, where prices are increasing 9% for homes at the 75% of the area's median home price, while appreciating only 5% for homes at 125% of the area's median home price. This demonstrates the struggle that the first time homebuyer is facing: rising rates and higher home price appreciation. Below is a chart of where home prices are overvalued and undervalued

Factory orders fell 1.4% in January reversing a string of gains. This is interesting simply because most of the regional Fed reports and the ISM data are showing strength in new orders, which was the weakness in this report.

No comments:

Post a Comment