| Last | Change | |

| S&P Futures | 2504.0 | -1.3 |

| Eurostoxx Index | 382.6 | 0.6 |

| Oil (WTI) | 50.3 | 0.8 |

| US dollar index | 85.8 | 0.2 |

| 10 Year Govt Bond Yield | 2.27% | |

| Current Coupon Fannie Mae TBA | 103.24 | |

| Current Coupon Ginnie Mae TBA | 104.21 | |

| 30 Year Fixed Rate Mortgage | 3.85 |

Stocks are flattish after the FOMC statement contained few surprises. Bonds and MBS are flat as well.

As expected, the Fed made no changes to interest rate policy and left the Fed Funds rate unchanged. They also announced their plan to implement their previously announced reduction in reinvestment in order to shrink their balance sheet. The projections were pretty much the same as they were in June, with the exception of June GDP, which was bumped up a tenth of a percent to 2.4%. Inflation was unchanged at 1.6% and unemployment was unch'd at 4.3%.

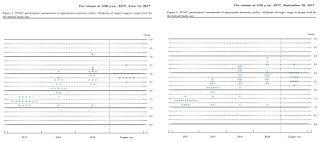

The dot plot reduced expected rates in 2018 by 3/16 or about 19 basis points. You can see a side by side comparison of the chart below:

The market reaction to the announcement was a drop in stocks and bonds, with the 10 year yield increasing to 2.27%, up about 3 basis points. The Fed Funds futures took up the probability of a December hike from about 60% to 70%.

Initial Jobless Claims fell to 259k last week as Texas claims fell, more than offsetting the increase in Florida claims.

Home prices rose 0.2% MOM and are up 6.3% YOY according to the FHFA House Price Index. We are still seeing strength out West, however New England is beginning to show some strength after lagging for a long time. The farm belt as well as the NY-NJ-PA area are still bringing up the rear.

The OECD is forecasting that global economic growth will be the fastest since 2011 this year and that growth will accelerate into next year. Ultimately this is good for the US economy, although it won't necessarily mean lower rates. Even if US growth isn't enough to push up bond yields, relative value trading by overseas investors could do the job.

In other economic news, the Philly Fed index continued its string of strong numbers, while the Index of Leading Economic Indicators posted a strong 0.4% reading. Expect to see a hit to growth however due to hurricanes Irma and Harvey.

Hurricane Maria, which has just devastated Puerto Rico now moves North close to the Eastern Seaboard. There are still the remnants from Jose just off New England which makes predictions difficult. The East Coast from NC to Maine have at least some risk.

Home equity increased over 10% YOY, according to CoreLogic. Total home equity reached $8 trillion, which is double the level of 5 years ago. Negative equity decreased by 10%, to 2.8 million homes or 5.4% of all mortgages. 750,000 homes regained positive equity. Even if rates don't go down from here, increasing home equity will create refinance opportunities, especially for cash-outs to refinance credit card debt and refis from FHA to conforming to remove MI requirements. A lot of FHA loans done 4 or 5 years ago now have enough equity to refi into a conforming.

No comments:

Post a Comment