| Last | Change | Percent | |

| S&P Futures | 2114.2 | -3.9 | -0.18% |

| Eurostoxx Index | 2918.0 | -71.0 | -2.38% |

| Oil (WTI) | 49.83 | -0.7 | -1.44% |

| LIBOR | 0.658 | 0.001 | 0.21% |

| US Dollar Index (DXY) | 94.13 | 0.180 | 0.19% |

| 10 Year Govt Bond Yield | 1.65% | -0.03% | |

| Current Coupon Ginnie Mae TBA | 105.8 | ||

| Current Coupon Fannie Mae TBA | 104.9 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.67 |

Stocks are lower this morning on no real news. Bonds and MBS are up as sovereign bonds rally globally.

The 10 year has broken out of its range and is now trading at 1.65%. The catalyst has been lower rates throughout the world. The German 10 year Bund is now trading at 2 basis points. The Japanese Government Bond yields negative 13 basis points. At some point, gold has to become interesting as an investment. The knock on gold was always that there is no yield, but compared to long term sovereign bonds that have no yield and (probably) no upside, why not? Definitely a better risk / reward.

Mortgage originator and servicer Walter Investment got slammed yesterday after the CEO resigned. Regulatory difficulties and costs were the catalyst. The stock has lost 82% of its value over the past year.

In economic news, initial jobless claims fell to 264k from 268k the week before. So in spite of the low job creation numbers, we aren't seeing firms lay off people yet.

Consumer confidence fell slightly in June to 94.3 from 94.7 according to the University of Michigan Consumer Sentiment Survey

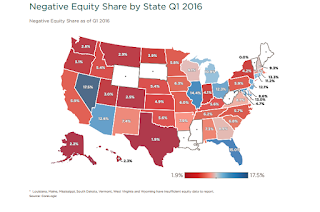

268,000 homes regained positive equity in the first quarter, according to CoreLogic. They estimate that 4 million homes (or about 8% of the homes with a mortgage) have negative equity. 18% of homes have less than 20% equity. Negative equity remains a problem in the Northeast, the Rust Belt and FL, NV, and AZ.

Ex Fed Head Narayana Kochlerakota argues the Fed should be doing more to get inflation up. Not only should they hold off on raising rates until the core PCE is above 2%, but it should pay nothing on excess reserves.

The long-term potential for banking as a sector is huge but equally we have to understand there are huge technological changes underway in the world. Financial institutions who move along with technology will do well while other will not do that well.

ReplyDeleteMultibagger

Value Pick

We see a recovery for oil prices in H2 2017 from current levels, with OPEC production cuts, a slowdown in global supply growth and seasonally firming demand driving up prices,” BMI Research said, although it added that “large-volume supply additions will keep price growth flat year on year in 2018.

ReplyDeleteStock Market Advisory

Commodity Market Advisory