| Last | Change | Percent | |

| S&P Futures | 2098.0 | -6.9 | -0.33% |

| Eurostoxx Index | 3031.4 | -32.1 | -1.05% |

| Oil (WTI) | 48.5 | -0.6 | -1.22% |

| LIBOR | 0.673 | -0.001 | -0.15% |

| US Dollar Index (DXY) | 95.38 | -0.510 | -0.53% |

| 10 Year Govt Bond Yield | 1.71% | -0.09% | |

| Current Coupon Ginnie Mae TBA | 105.6 | ||

| Current Coupon Fannie Mae TBA | 104.7 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.63 |

Stocks are lower this morning after a weak jobs report. Bonds and MBS are up.

Jobs report data dump:

- Nonfarm payrolls + 38k

- 2 month payroll revision - 59k

- Unemployment rate 4.7%

- Average weekly hours 34.4

- Average hourly earnings +0.2% MOM / +2.5% YOY

- Labor force participation rate 62.6%

- Underemployment rate 9.7%

Massive disappointment in the the payroll number. Lowest print in 6 years. If you add in the 2 month revision, May was negative. While the Verizon strike is adding some noise to these numbers (could be depressing them by as much as 35k), it was a huge miss compared to the 160k street estimate. The labor force participation rate seems to be heading back towards the lows of last September, which puts the number back towards lows not seen since the 1970s. The population increased by 205k while the labor force fell by 458k. The unemployment rate fell to 4.7%, however that is due to half a million people exiting the labor force.

The conclusion from the markets? Take June off the table. The market probability of a rate hike in June is now about 4%. You can see this in bonds: The 10 year bond yield fell 9 basis points on the report, but the real tell is the 2-year, which fell 11 basis points to 78 basis points. Between this report and the fears over Brexit (The UK leaving the EU) gives Janet Yellen enough uncertainty to not want to upset the apple cart any more. The focus will now turn to July. You can see the dramatic move lower in yields below:

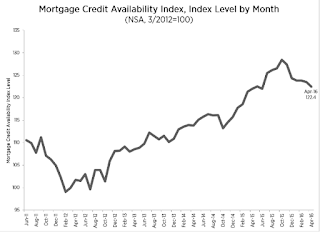

Mortgage Credit Availability fell in April, according to the MBA. We saw tightening primarily in jumbos and high balance loans, which were offset by loosening in the new low-downpayment conforming loans.

No comments:

Post a Comment