| Last | Change | |||

| S&P futures | 2737 | 10 | ||

| Eurostoxx index | 380.51 | 3.77 | ||

| Oil (WTI) | 75 | 1.06 | ||

| 10 Year Government Bond Yield | 2.87% | |||

| 30 Year fixed rate mortgage | 4.52% | |||

Stocks are up this morning as emerging markets rally overnight. Bonds and MBS are flat.\

Today should be quiet as markets close early ahead of the 4th of July holiday.

Manufacturing continued to plow ahead in June, according to the ISM PMI Index. The responses from the survey participants show that the trade war is having some impact. One food and beverage company mentioned that they were shifting some production to Canada in order to escape Chinese retaliatory tariffs on US products. Inflationary pressures are present in higher commodity prices, and we are seeing secondary pressure from transportation (higher oil prices and driver shortages are pushing up prices here). Pretty much every commodity is seeing price increases, and there are material shortages in aluminum, steel, and electronic components. Overall, this is a strong manufacturing reading, which is usually associated with 5.2% GDP growth. Of course, manufacturing isn't the driver of the economy it used to be, but it is still a strong reading.

The Fed is going to pay close attention to this report, particularly the part about labor shortages. From their standpoint, inflationary pressures from commodity price inflation are generally considered transitory and therefore temporary. An old saw in the commodity markets is that the cure for high prices is high prices. The potential dampening effect from trade battles will also concern them. IMO, until you start seeing wage inflation pick up in a meaningful way the Fed will consider this a push. Note we will get some insight into this on Thursday when the minutes from the June meeting are released.

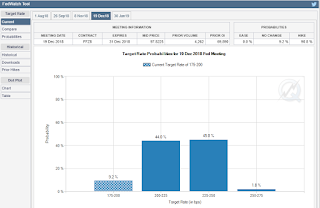

The Fed funds futures are still handicapping a 76% chance of a 25 bp hike in September and a 45% chance of one in December as well.

Construction spending rose 0.4% in May, and is up 4.5% on an annualized basis. Residential construction was up 0.8% MOM and 6.6% YOY, as an increase in private resi construction was offset by a drop in public housing spending. Manufacturing construction took a step back, which will be something to watch (could just be noise, but could be trade-related). Meanwhile retail (specifically mall-related construction) is in the doldrums as vacancy rates soar.

Home price appreciation accelerated in May, according to the CoreLogic Home Price index. Prices rose 1.1% MOM and are up 7.1% YOY. The housing shortage is well-documented, and the problem is most acute at the entry-level. Higher rates and low inventory is also preventing some people from moving. CoreLogic estimates that 50% of the mortgage market has a rate of 3.75% or lower. According to CoreLogic's model which compares home price appreciation to income appreciation, we are seeing large pockets of overvaluation, particularly in Florida, the West Coast, the sand states, and parts of the Eastern Seaboard. The Midwest remains cheap.

Trump is reportedly mulling whether to pick a new Chief of Staff. One of the potential candidates is current CFPB Chairman Mick Mulvaney. Mulvaney is currently doing double duty as OMB and CFPB head, so a change for him would be unlikely, but the possibility is still there. Here are the implications of a change and who might replace him.

Labor shortages continue to be an issue in the Midwest. Companies are now less squeamish about hiring ex-cons. In Elkhart, (where the labor market is so tight it sports a 2% unemployment rate and even the KFC is offering sign-on bonuses), companies are hiring convicted felons (except sex offenders) and are waiving drug tests. It is a back-to-the future scenario, where the labor market is suddenly transported back to 1955.

No comments:

Post a Comment