| Last | Change | |

| S&P Futures | 2681.3 | 13.3 |

| Eurostoxx Index | 380.1 | 7.3 |

| Oil (WTI) | 61.3 | -0.6 |

| US dollar index | 84.2 | 0.0 |

| 10 Year Govt Bond Yield | 2.86% | |

| Current Coupon Fannie Mae TBA | 102.688 | |

| Current Coupon Ginnie Mae TBA | 102.938 | |

| 30 Year Fixed Rate Mortgage | 4.33 |

Stocks are higher as Monday's sell-off gets smaller in the rear view mirror. Bonds and MBS are down.

The Senate reached a 2 year budget deal to fund the government which bumps up spending by $300 billion. It suspends the debt ceiling for a year, bumps up defense and social spending and provides additional relief to Puerto Rico. We'll see if this can get through the House: the left is mad there is no immigration deal, while the right objects to the increase in spending.

Initial Jobless Claims hit a 45 year low last week, falling to 221,000.

The government is cracking down on VA IRRRL abuses and has told 9 lenders that they will remove them from the VA program if they don't find a way to curtail refinance abuses. “We are targeting our actions at outliers, not at lenders who are genuinely helping to support responsible lending,” Ginnie Mae Chief Operating Officer Michael Bright wrote in a statement through a spokesman. These abuses are bad for the affected veterans who borrow the funding fee, but they also affect others, particularly other borrowers in FHA / VA loans. Part of the reason why it has been so difficult to get any fee pickup as you move up in rate has been due to serial refinancings. Investors are reticent to purchase high coupon TBAs.

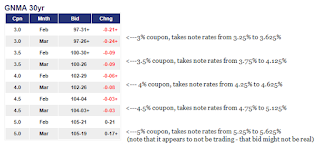

I'll try and explain what is going on, but first a little background on how government loans are priced. Suppose a borrower wants to get a lender credit and is willing to pay a higher rate to do it. The TBA rate stock is used to determine the rate / fee that goes to the borrower. If a borrower wants a note rate between 4.25% and 4.625%, their loan will be sold into a 4% TBA, which is trading at 102.8125. The difference between par and 102.8125 +/- any lender credits is what pays LO comp, covers the cost of doing the loan, overhead, etc. The higher up you go in the rate stack, the more profit margin you have to play with, and therefore the bigger credit you can offer. If the borrower is willing to take a note rate of 4.75% to 5.125%, the baseline TBA price is 104.125 and that differential between the TBAs represents the increased lender credit the borrower can receive. Here is the problem: What happens if a borrower wants to go even higher and get a bigger credit? If there is no demand for the next TBA coupon (say 5%), then the increase might not be a point - it might only be half a point. Note today that all the TBAs are down for the day except for the 5% note rates. That means those prices are stale and probably not real.

Why would investors not be interested in buying the 5% Ginnie note rates? It has to do with prepayment speeds. If you are an investor, you are paying well over par (in this case, maybe 4 or 5 points over par) in order to get something that will give you par back at some point. In other words, you are paying 104 and once the loan pays off you are getting 100, which is a loss of 4 points. You are betting that you will get back that 4 points over time because the note rate is higher than what you could typically get for an instrument with similar credit risk. So, if you buy a bond over par it might take a few years to recoup that premium you paid. If the borrower refis in 6 months, you lose. Ginnie Mae investors have been burned over the past several years paying 105 - 106 for a security that pays them par in a few months when the borrower gets a VA IRRRL. Investors have become gun-shy at buying the higher coupon TBAs, and that affects everybody, not just the veteran who rolled a 1.5% funding fee into a new mortgage for a smaller monthly payment of a couple bucks and the right to skip a payment or two.

The Elizabeth Warrens of the world will focus on the veteran who is paying a big fee for a refi that will take several years to break even, but Ginnie will be focused on some of the unintended consequences of this, and it really becomes evident when you look at how it affects the more marginal borrower. Ginnie Mae was created to finance the tougher credits - the first time homebuyer, the cash-strapped buyer, manufactured homes, lower income / credit buyers. These homebuyers usually have risk factors that will translate into bigger loan level pricing adjustments, and will often require a higher note rate to make the math work. If those higher note rates are not available, then it becomes tough to finance those people, and Ginnie Mae's mission is to help get these people loans. Which is why Ginnie is very sensitive to the actual investors of Ginnie Mae MBS as well as the veteran. The behavior of a few rogue lenders really does impact the whole market and pretty much everyone who takes out a government loans.

No comments:

Post a Comment