| Last | Change | |

| S&P Futures | 2751.3 | 4.5 |

| Eurostoxx Index | 400.3 | 1.9 |

| Oil (WTI) | 62.0 | 0.2 |

| US dollar index | 86.0 | 0.1 |

| 10 Year Govt Bond Yield | 2.50% | |

| Current Coupon Fannie Mae TBA | 102.313 | |

| Current Coupon Ginnie Mae TBA | 103.063 | |

| 30 Year Fixed Rate Mortgage | 3.92 |

Stocks are higher this morning on good economic data out of Europe. Bonds and MBS are down.

Small Business Optimism slipped slightly in December, capping the strongest year in the index since the early 80s. Hiring was sluggish in December, with a lack of qualified workers being the biggest problem in construction and manufacturing. Compensation is trending up as well, as a net 23% of small businesses intend to raise compensation this year.

Job openings were little changed in November, according to the JOLTs survey. This was a slight drop from October, and a touch below expectations. Openings increased for retail, and fell for government, transportation, and utilities. The quits rate was unchanged at 2.2%. Until we start seeing the quits rate move up, we probably won't be seeing broad-based wage inflation.

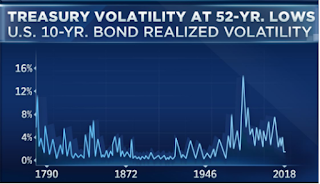

Volatility in the bond market has hit a 52 year low, according to a Bank of America / Merrill Lynch report. This is not surprising: volatility in the stock market is also at record lows. Volatility is generally a sign of stress in the system, and it tends to fall during periods of stronger growth.

The drop in bond market volatility has major implications for the mortgage market as well, and helps explain a bit of why mortgage rates are behaving the way they are. While the 10 year has been steadily moving higher over the past few months, mortgage rates have been relatively stable. While mortgage rates do tend to lag Treasuries, something else has been going on, and that something has been low volatility.

30 year fixed rate mortgages have an embedded option in them, which is the right of the borrower to prepay their mortgage without penalty at any time. That right to prepay is worth something, and that value explains the yield differential between government backed mortgage debt and Treasuries. The value of the prepayment option is determined largely by the volatility of the bond market - when volatility rises, the right to prepay is worth more, and when volatility falls, it is worth less. So, when the market is stable, investors bid up mortgage backed securities as the value of that option falls, which translates into tighter MBS spreads and lower mortgage rates. In fact, the difference between a 30 year fixed rate mortgage and an adjustable rate mortgage is driven by the value of that prepayment option and risk-shifting between borrower and lender. When volatility is low, the borrower is paying less for that option and 30 year fixed rate mortgages will be more attractive than ARMS. When volatility is high, ARMS will be much cheaper. During periods of low volatility, it makes sense to scoop up that prepay option on the cheap and take out a 30 year fixed rate mortgage. When volatility is high, you will end up getting a much lower initial rate with the ARM. Co-incidentally, the economic backdrop (stronger growth, accelerating inflation, and a Fed raising short term rates) also favors the 30 year fixed over ARMS.

No comments:

Post a Comment