| Last | Change | |

| S&P Futures | 2578.8 | -12.3 |

| Eurostoxx Index | 391.2 | -3.2 |

| Oil (WTI) | 56.9 | 0.1 |

| US dollar index | 87.8 | 0.0 |

| 10 Year Govt Bond Yield | 2.34% | |

| Current Coupon Fannie Mae TBA | 102.875 | |

| Current Coupon Ginnie Mae TBA | 103.938 | |

| 30 Year Fixed Rate Mortgage | 3.95 |

Stocks are lower this morning on overseas weakness. Bond and MBS are down.

Initial Jobless Claims rose to 239k last week. We are at levels not seen since the Vietnam War.

Fannie Mae is working on an initiative to increase affordable housing, by increasing access to construction loans. Under the program being considered, lenders will be able to sell construction loans to Fannie Mae on the day construction begins instead of the day construction is completed. This will alleviate the issue of lenders having to hold a construction loan on their books for months and hopefully spur more construction activity. This will probably have only a marginal impact on housing supply, as the supply issue is being driven more by labor and land shortages, as well as regulation.''

Meanwhile, NAR is warning that the GOP tax plan will bring affordable housing construction "to a halt." The Low Income Housing Tax Credit will remain in place, however the private activity bonds used to finance affordable housing construction will be eliminated. Second, as tax rates fall, the value of the tax credits used to encourage affordable housing construction will fall in value. Affordable housing advocates estimate that tax reform will cut affordable housing construction by 2/3.

Fannie Mae's Home Purchase Sentiment Index fell from its highs in October. "The modest decrease in October's Home Purchase Sentiment Index is driven in large part by decreases in favorable views of the current home-buying and home-selling climates, a shift we expect at this time of year moving out of the summer home-buying season," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "Indicators of broader economic and personal financial sentiment remain relatively steady. Overall, these results are consistent with our view that the housing market will continue its slow, upward grind through 2018." Despite the strong employment numbers lately, the survey saw an increase in the number of people worried about their jobs.

The NYSE just launched FANG futures, which are led by Facebook, Amazon, Netflix, and Google. Definitely a bull market phenomenon - reminds me of stock split beepers, which were advertised in Barrons back in the late 90s.

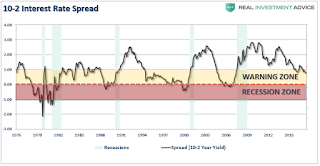

Some market watchers are warning that the flattening yield curve is signalling a recession. The favorite metric is the 2s-10s spread or the difference in yield between the 10 year bond and the 2 year bond. While a flattening yield curve is often associated with longer-term economic weakness, it is also associated with Fed tightenings. In fact, the yield curve has flattened in every tightening cycle since 1980. That said, nothing in the data suggests the economy is weakening - if anything the economy is accelerating. The Fed is tightening in order to bring its unusually accommodative policy back to a semblance of normalcy, not to fight inflation (despite what they are saying about it). They are being extremely cautious and are doing everything they can to prevent a Fed-induced recession.

No comments:

Post a Comment