| Last | Change | |

| S&P Futures | 2124.8 | 5.0 |

| Eurostoxx Index | 338.3 | -0.7 |

| Oil (WTI) | 47.1 | 0.2 |

| US dollar index | 88.3 | -0.2 |

| 10 Year Govt Bond Yield | 1.87% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 3.62 |

Stocks are higher as the FOMC begins its November meeting. Bonds and MBS are down.

The PMI Manufacturing Index improved in October to 53.4 from 51.1. We are starting to see increases in input prices be passed through to customers.

The ISM Manufacturing Index ticked up to 51.9 from 51.6.

Bonds had their worst October in 2 years as European bonds slid on bets that there will be no further stimulus out of the ECB. US bond yields are going to be naturally pulled in the direction of overseas bonds absent any info coming out of the US. If the global economy is truly out of the woods, then the path of least resistance for bonds is down, which means gradually increasing interest rates going forward. However, if the Chinese economy blows up as asset prices fall, then all bets are off.

The FOMC meeting begins today and we will get the announcement tomorrow. The markets are assuming that we will have no change in monetary policy at this meeting. The Fed Funds futures are assigning a 71% probability of a 25 basis point hike in the Fed Funds rate at the FOMC meeting in December. That said, we could see some volatility around the statement tomorrow afternoon if they deviate from the script (which probably isn't going to happen 1 week before the election).

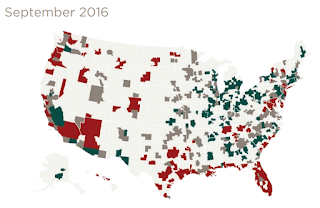

Home prices rose 1.1% MOM and 6.3% YOY according to CoreLogic. Home equity wealth has doubled over the past 5 years to $13 trillion. This works out to be about $11,000 per homeowner, however the geographic split is pretty wide. In September, CoreLogic reported that 112 markets are overvalued, with 19 of them in Texas. The heat map is shown below, where red = overvalued and green = undervalued.

Part of what is driving home prices into overvalued territory is supply, and as we know, builders are adding to inventory only grudgingly. What is going on? Ultimately credit is a big driver, but not at the residential mortgage level, it is at the bank level. There has been a huge bifurcation in credit over the past several years, where big builders like D.R. Horton or Lennar can access the bond market at very favorable rates, while the smaller builders are having trouble getting loans from their local bank. In addition, most of the lending has gone to multi-fam, not single fam. Second, lack of skilled labor and land are playing a part. The skilled labor part will fix itself on its own as high wages attract more people to the business. Land is a more difficult issue, however the price differential between the exurbs eventually will win out.

If Halloween candy were bonds:

No comments:

Post a Comment