| Last | Change | Percent | |

| S&P Futures | 2102.8 | 17.8 | 0.4% |

| Eurostoxx Index | 3054.4 | -6.4 | -0.21% |

| Oil (WTI) | 40.26 | 0.5 | 0.36% |

| LIBOR | 0.628 | -0.001 | -0.20% |

| US Dollar Index (DXY) | 94.76 | -0.139 | -0.15% |

| 10 Year Govt Bond Yield | 1.78% | -0.01% | |

| Current Coupon Ginnie Mae TBA | 105.5 | ||

| Current Coupon Fannie Mae TBA | 104.8 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.62 |

Markets are higher this morning as commodities rally. Bonds and MBS are flattish.

Housing starts fell 9% MOM in March to an annualized rate of 1.09 million, a highly disappointing number. Both SFR and multi-fam fell. This is the lowest level since October. Building Permits also fell around 8%, hitting a 1 year low. It is astounding that we have such a deficit of housing in this country, and are building 25% fewer homes than we did before the bubble, Housing (or lack thereof) has been the reason why this recovery has been so weak. Take a look at the chart below, which shows housing starts from 1959. Typically you see V-shaped recoveries in housing starts, however this time you haven't. Granted some of that was due to oversupply from the bubble years, but that excess inventory got worked off years ago. Is the problem a lack of skilled labor? Credit? Regulation? Probably all three.

While housing starts remain depressed, builder confidence is still strong, with the NAHB Housing Market Index (a measure of homebuilder sentiment) holding steady at 58 in April. The builders continue to report big increases in average selling prices, although gross margins are lagging. This means input prices (raw land, sticks and bricks, and labor) are rising faster than prices. Given that incomes aren't rising in the mid-high single digits the way ASPs have been, we have to be hitting the ceiling. Note we will get earnings from Pulte and D.R. Horton on Thursday.

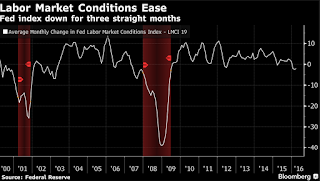

There are signs of weakness building in the labor market - temporary employees are typically the canary in the coal mine, and temp hiring is falling. Historically, that has been an early warning sign of a recession. Separately, the Federal Reserve's Labor Market Conditions Index, which is a meta-index of leading and lagging indicators has been turning downward. Could 2015 have been the peak of the labor market recovery?

Certainly things are not going swimmingly in the financial sector: Goldman reported a 60% drop in earnings as revenues fell. The bright side? The multi-billion fines from the government may finally be in the rear view mirror. I wonder if you tally up all the bailout money and compare it to the revenues the government has received in paybacks, fines, and Fannie Mae profits how profitable was the Great Recession for the government.

No comments:

Post a Comment