| Last | Change | Percent | |

| S&P Futures | 2084.6 | 5.4 | 0.26% |

| Eurostoxx Index | 3460.5 | 11.6 | 0.34% |

| Oil (WTI) | 40.1 | -0.4 | -1.09% |

| LIBOR | 0.37 | 0.003 | 0.68% |

| US Dollar Index (DXY) | 99.21 | 0.217 | 0.22% |

| 10 Year Govt Bond Yield | 2.24% | -0.01% | |

| Current Coupon Ginnie Mae TBA | 104.1 | ||

| Current Coupon Fannie Mae TBA | 103.5 | ||

| BankRate 30 Year Fixed Rate Mortgage | 3.83 |

Markets are higher this morning after Mario Draghi said the ECB will do what it must to raise inflation as quickly as possible. Bonds and MBS are rallying.

Fed Heads Bullard and Dudley will be speaking on the economy today.

Weakness in Europe has pushed bond yields down overseas, and the relative value trade should start having an effect here. The German Bund has been incredibly volatile over the past year, trading in a range of 5 basis points to 106 basis points. It currently stands at 47 basis points and looks to be headed lower.

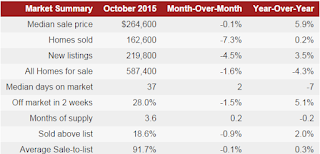

Home sales stalled in October, according to Redfin. Sales increased 0.3%, and the median house price rose about 6% year over year. TRID probably played a role in bumping up September's numbers and lowering October's.

Americans are re-leveraging. Household debt reached $12 trillion in the third quarter according to the New York Fed. Mortgage debt, student loan debt and auto loans all increased. The delinquency rate for student loans is an astounding 11.6%.

Credit is loosening somewhat, according to Ellie Mae. Average FICO scored dropped a point to 722. Note that time to close a loan (46 days) did not increase in October, so if TRID is slowing down closings, it isn't apparent in the numbers, at least not yet.

No comments:

Post a Comment