| Last | Change | Percent | |

| S&P Futures | 1941.7 | -8.8 | -0.45% |

| Eurostoxx Index | 3292.3 | -21.6 | -0.65% |

| Oil (WTI) | 104.4 | 0.1 | 0.06% |

| LIBOR | 0.23 | -0.001 | -0.22% |

| US Dollar Index (DXY) | 80.72 | -0.100 | -0.12% |

| 10 Year Govt Bond Yield | 2.63% | -0.02% | |

| Current Coupon Ginnie Mae TBA | 106.3 | 0.1 | |

| Current Coupon Fannie Mae TBA | 105.2 | -0.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 4.21 |

Stocks are weaker this morning after the World Bank cut its global economic forecast. Bonds and MBS are stronger.

Mortgage applications rose 10% last week in spite of a large increase in interest rates. The 10 year bond yield increased 11 basis points and the Bankrate 30 year fixed rate mortgage increased 2 basis points. Purchases rose 9.3% while refis increased 11%. Refis rose to 53.6% of all applications.

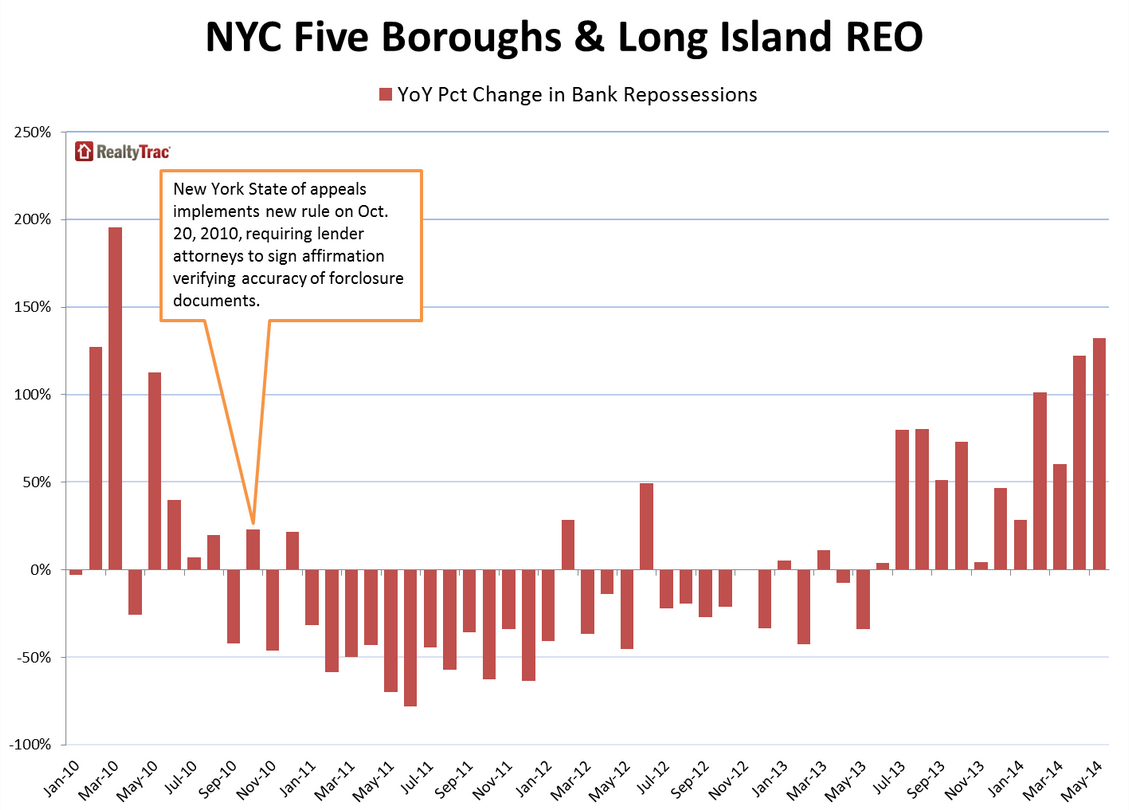

Foreclosure filings decreased 26% in May, according to RealtyTrac. The judicial states are reporting increases in foreclosure activity as they finally begin to address their bloated foreclosure pipelines. We are starting to see increases in foreclosure activity in New York, New Jersey, Connecticut and Massachusetts.

The NAR released a study showing that housing supply remains constrained and 2 factors explain it. First, a lack of housing turnover due to underwater homes. The number of underwater homeowners stood at 6.3 million in Q1, down from 11.8 in Q111, but still elevated compared to historical numbers. This explains why existing home sales numbers have been weak. Second, new construction has been weak since the bust. In fact, new home construction has lagged job growth over the past 3 years by a large factor. These supply constraints are driving price higher. Check out this chart, which looks at the ratio of jobs created to housing starts.

Of course there are caveats with this study, but it still shows how much housing construction is lagging.

What is going on in the bond market? The rally in bonds has caught many investors off guard and many pros went into this rally underweight bonds to begin with. Perhaps the ECB cutting rates to below zero on deposits is driving it, but the fundamentals in the US argue for higher rates, not lower rates. Bearish interest rate bets in the CME Eurodollar futures are at a record.

No comments:

Post a Comment